Integra essentia ltd share price target 2025, 2030, 2040, 2050

Hello friends 😄 , In today’s article we will share with you a great story with great stock insights of a company, and Share Target also. Before we jump 🦘 to stock target, first we know what company does and how Integra Essentia makes money in a competitive world.

How is this company different from another competitor?Let’s get started to become great investors.💵 We start with company business, then we move towards Integra essentia ltd share price target 2025 to 2030 🤑

Integra essentia official website link 🔗

Company Introduction

Integra Essentia Ltd share price target 2025. This Essentia share was a small-cap company with a market capitalization of approx. ₹ 324.58 Cr. Share price is currently trading at ₹ 3.03; it is a penny stock.

Integra Essentia Ltd. is a diversified company that provides a various range of products for day-to-day use, in modern society.

The company was incorporated in 2007 and started with textile work. Before the company name was Integra Garments and Textile Ltd., after the company was acquired by Mr. Vishesh Gupta, he changed the whole management with the name. In 2022, the company name changed to Integra Essentia Ltd., a multi-faced company. Aim to become a prominent player in the market by providing day-to-day essentials and changing life standards.

Company focuses on sustainable products and essential services. Company operates in different sectors like agriculture, infrastructure, and healthcare. Integra essentia ltd share price target 2030 company can give multifold return in 5 years according to company financials.

Integra Essentia products and services

So, you understand the company overview and come to the products and services section, then we move to your favorite topic, Integra essentia ltd. share price target 2025, 2030.

1. FMCG business: Agro products

This company does trading of agro products only in certified agro products and general products.Such as pulses, wheat, and rice. Grain, tea, coffee, dry fruit, species, vegetables, and many other products

2. Textile Business: Clothing

The company also deals with the clothing & textile segment, all types of fabric.Essentia’s product portfolio consists Man, women, kids to domestic use.Curtains, fabrics, carpet. very high-end product

3. Energy business

On March 31, 2022 company started business in the energy sector. The company offers material for all projects. Hydrogen cell power generator and batteries.😳 Many products are there.

4. Infrastructure Business

Company engaged in trading business of construction materials for construction and infra development TMT bars, cement, bricks, A to Z construction items.

- Plumbering system.

- Electrical equipment

- Rainwater harvesting system

- Hybrid irrigation system, and many more.

After reading this, I think the company can give multibagger return😄💵 After reading this, you also think like that because company business was interesting and a good sector.

But wait After reading this business model, we can’t put our hard-earned money in this stock; without reading financial, promoter pledging, holding, etc., many things are there.After knowing any company’s financial and business model, don’t overexcited to buy share and don’t create panic and FOMO. This is the sign of bad investors. Let’s come to market terms, then Integra essentia ltd share price target 2025💵

Market view of Integra essentia

price summary

- Today’s high – ₹ 3.07

- Today’s low – ₹ 2.98

- 52 week high – ₹ 5.25

- 52 week low – ₹ 2.76

TERMS | VALUE |

Market capitalization | ₹ 324.58 Cr. |

Enterprise value | ₹ 330 Cr. |

No.of Shares | 106.77 Cr. |

P/E | 32.94 |

P/B | 1.91 |

Face value | ₹ 1 |

Div.yeild | 0% |

Book Value | ₹ 1.59 |

Cash | ₹ 1.96 Cr. |

Debt | ₹ 7.38 Cr. |

Promoter holding | 15.98% |

EPS | ₹ 0.09 |

Sales Growth | 14.85% |

ROE | 15.90% |

ROCE | 17.13% |

Profit growth | 131.36% |

Top peer comparison of Integra essentia ltd with Market capitalization

Read also Ceigall India Ltd Share price target 2025

Here are the main competitors of Integra Essentia Ltd. with their approximate market capitalization.

1. Shree Karni Fabcom Ltd.

- Market capitalization of ₹ 555.12 Cr.1

- Karni Fabcom is a manufacturer of technical textiles that provide high-quality fabrics and specialized fabrics tailored.

2. AB cotspin India

- Market capitalization of ₹ 488.36 Cr.

- Ab Cotspin is specialized in the manufacturing of cotton yarn, knitted fabric, etc.

3. Karnika Industries

- Market capitalization of ₹ 458.72 Cr.

- Karnika Industries specializes in manufacturing and exporting; they are the top manufacturers of kids wear.

This is all about competitors, Read carefully to understand the Integra Essentia Ltd share price target of 2025.

Share price Chart of Integra essentia ltd

This second chart is a monthly chart. So now the question is, How to read the chart and what chart is trying to tell us?

This is the overall monthly chart. Look at the bottom of the chart; this line is called volume. From 2022 to 2024 monthly chart. which shows a Rs 0.90 per share is the all-time low in 2022 and the all-time high is around Rs 7.70 per share look at the fluctuations.

Charts showing us very long consolidation is going on. In Jan 2024, good buying volume sprouts were seen in charts after that share touched the top of Rs 7.70 per share and the fall to 4 rs per share and now consolidating.

This is the right time to buy stock for the long term with minimum investment. After all this, some buying volume was seen in August 2024.

Integra essentia Ltd share price target 2025 is penny stock, and this type of stock is always risky for your pocket. 💵🚨😆

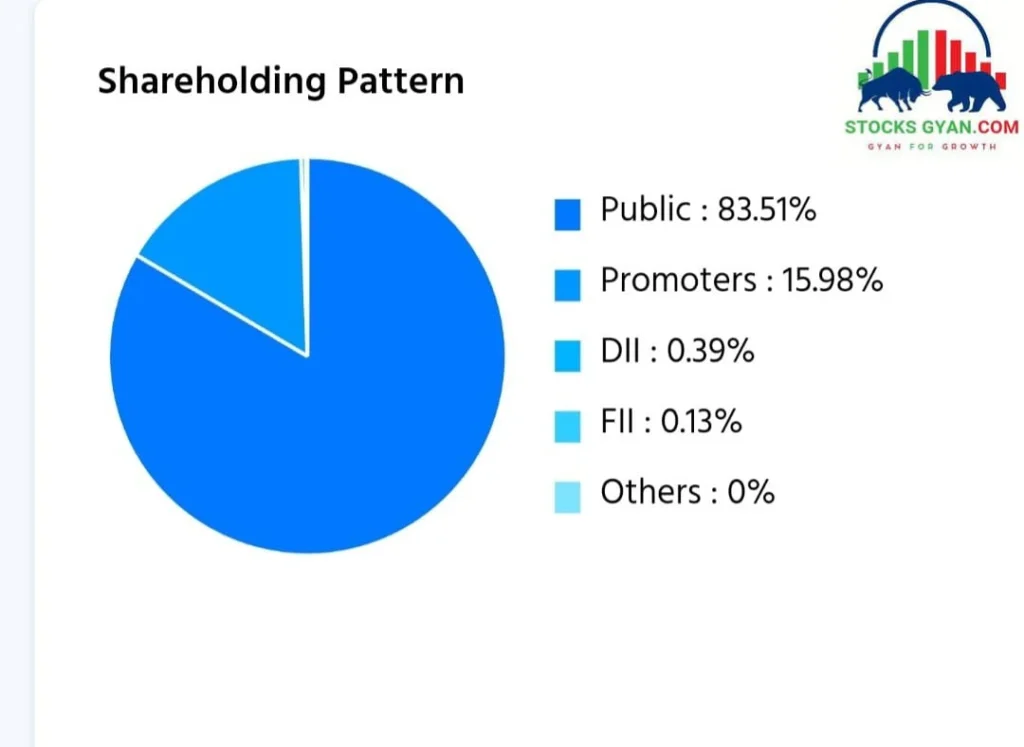

Integra essentia Shareholding pattern

- Promoter – 15.98%

- public – 83.51%

- DIIs – 0.39%

- FIIs – 0.13%

The majority stake is owned by the public; this is not good for the company.

Integra essentia ltd Financial

profit and loss all Figures are in Cr.

Particular | MAR 2021 | MAR 2022 | MAR 2023 | MAR 2024 |

Net Sales | 0 | 68.53 | 241.41 | 277.27 |

Total Expenditure | 0.17 | 67.47 | 238.30 | 272.52 |

Operating profit | -0.17 | 1.05 | 3.12 | 4.75 |

Other income | 0 | 0.08 | 4.09 | 18.50 |

Interest | 0.26 | 0.05 | 0.01 | 0.57 |

Depreciation | 0.18 | 0 | 0.03 | 3.72 |

Expectional Items | 0 | 0 | 0 | 0 |

Profit before Tax | -0.61 | 1.09 | 7.18 | 18.97 |

Tax | 0 | 0 | 0.57 | 3.68 |

Net profit | -0.61 | 1.09 | 6.60 | 15.28 |

Adjusted EPS(Rs) | -0.03 | 0.05 | 0.07 | 0.16 |

After reading the recent financial statement, what do you thinks? Integra essentia was able to give multifold return.

So you see the financials of the company. Now we discuss the recent financial results of the company, then we will move to Integra essentia ltd share price target 2025.

In the SEP 2024 quarter, Integra Essentia Ltd. experienced a 48.84% 🦘increase in revenue, but its net profit declined by 88.57%, indicating poor performance for the company.

In the DEC 2024 quarter, Integra Essentia Ltd. experienced a 100.83% 🦘increase in revenue, and company net profit increased by 51.96 %, indicating outstanding performance for the company.

Now let’s move to Integra essentia ltd share price target 2025.

Integra essentia ltd share price target 2025, 2030, 2040, 2050

Share target 🎯 years | Share price target |

2025 | ₹ 4.20 |

2026 | ₹ 6.10 |

2027 | ₹ 6.90 |

2028 | ₹9.50 |

2029 | ₹ 8.10 |

2030 | ₹ 13.20 |

2040 | ₹ 21.20 |

2050 | ₹ 29.60 |

So, now read the detailed analysis of Integra essentia ltd share price target 2025

Read also Vikas ecotech share price target 2030

Integra essentia ltd share price target 2025

| Integra essentia share price 2025 | Rs. |

| First Target 🎯 | 4.20 |

| Second target 🎯 | 6.90 |

| Third Target 🎯 | 8.10 |

In the future of technology and AI, the Integra Essentia business model was tech-oriented. Good going for long term; only day by day company product and service demand is increasing.

But economic challenges and competition are already there. To tackle the competition, companies need to expand exponentially.

So in the coming months of 2025, we can expect a minimum target of Rs 4.20 per share and a maximum target 🎯 will be 8.50 per share. Stay cautious because it is a penny stock.

To achieve this target or any high price target, the company has to do good business in a very competitive market. Buy at your own risk.

Integra essentia ltd share price target 2030

| Integra essentia share price target 2030 | Rs. |

| First Target 🎯 | 13.20 |

| Second Target 🎯 | 15.80 |

| Third Target 🎯 | 22 |

In this business, the main challenge is to deal with price fluctuation of any product because the company is doing trading business. The company is doing business in multiple sectors, which leads to product and logistics management.

For a long-term bet, you can buy shares with limited risk. Integra essentia ltd share price target 2030 can touch a minimum price of Rs 13.80 per share and a maximum target 🎯 of 22.

Integra essentia ltd share price target 2040

| Integra essentia share price Target 2040 | Rs. |

| First Target 🎯 | 25.30 |

| Second Target 🎯 | 28.30 |

| Third Target 🎯 | 38.20 |

The company has many challenges in the long term and many possibilities. Also, by the end of the day, Company is bound to do good business; otherwise, they fall like anything.

The company is already focused in many sectors, which is a disadvantage for the company. In 2040, the company’s minimum target 🎯 price will touch Rs 25.30 per share, and the maximum price will be Rs 38.80.

Company Strength 👍 and weakness 👎

Strength

- The company has Significantly decreased its debt by 21.10 Cr.

- Company is virtually debt free.

- Company has healthy interest coverage ratio of 34.13.

- Company has an effective cash conversion cycle of – 15 days.

Weakness

- The company has low EBITDA margin of 0.91% over past 5 years

- promoter stake has been decreased from 20.81

Conclusion

Integra essentia ltd share price target 2025 ,2030 The company has mixed financials because of business model.

The company started focusing on management for planning and execution of the project to achieve the target price , Company want to become top Manufacturer in India.

FAQs

Can Integra essentia become a multibagger?

Yes , But founder has to push the business fast because of competition. Other wise competitor will overtake the company

Is LIC is invested in Integra essentia ltd?

Yes Lic, life insurance corporation is invested in this company

Who owns Integra essentia ltd?

Mr. Vinesh gupta well known entrepreneur.

Disclaimer

All the information given on the website Stocksgyan.com, all news or ideas taken from a big website and presented here to add value, information, and accessibility, We are not SEBI-registered advisors.

We don’t provide fake news or fake information on our website. Please🙏 don’t buy any stocks after reading this blog. Do your own analysis. Because money is yours, profit is yours, and loss is yours..👍Happy investing😄

“Hello! I’m Harsh sahu, a seasoned blogger with over 2 years of experience in crafting engaging, SEO-optimized content. My expertise lies in creating high-quality, keyword-driven blog posts that drive traffic, boost rankings, and captivate audiences.”