Kamopaints Share price Target 2025, 2030, 2040, 2050

Hello friends 😀 “Colour your investment with success! Welcome to our kamopaints share price target 2025.“This time we discuss the paint sector. In this article we discuss about company introduction, financial, and share price target also to mint 🤑💰💵. First we start with the company introduction.

Read the full article and learn full details at one place, Stocksgyan.com. Let’s start to become great investors 💵😄.Kamdhenu ventures Share price target 2025.

Company Introduction

Kamopaints Share price target 2025, Kamopaints is a paint company specializing in paint production and paint distribution. A leading paint company that produces paints in Rajasthan, where the company makes exterior and interior emulsion, designer paints, construction chemicals, waterproofing chemicals, and other products.

It also outsources low-range products like enamel and distempers from the manufacturing unit. The company offers a very wide range of products, including designer paints for home and commercial property.

NSE: Kamopaints Share price trading at Rs 15 per share and hold Market capitalization of Rs 473.42 Cr. as of now Kamopaints Share price target 2025, That’s all about introduction.

In the next part we will discuss the main thing, the product part. Let’s move. Note: Kamo means kamdhenu.

Kamopaints Product and Services

Company manufactures high- to low-end products to meet customer demand. Emulsion to designer paints, enamel to Distempers, and many more. Let’s Discuss the Range of Products Offered by Kamdhenu Paints, Just have a look.

- Dual Paints Series

- Interior emulsion range

- Exterior emulsion range

- Designer Range

- Distemper Range

- Premium Enamel Range

- Wood finishes

- Waterproofing product

That’s all for the product range. Company Kamopaints come up with beautiful slog. “DESH KA NAYA RANG”.

Kamdhenu provides a very wide range of products, patterns, textures, and styles. this is all about product segments.

Now we move to Market Overview, then towards your favorite Kamopaints Share price target 2025.

Market View of Kamopaints

Price summary

- Today’s High – ₹ 15.34

- Today’s Low – ₹ 14.71

- 52 week High – ₹ 58.60

- 52 week low – ₹ 14.51

TERMS | VALUE |

Market capitalization | ₹ 477.82 Cr. |

Enterprise value | ₹ 477.67 Cr. |

No.of shares | 31.44 Cr. |

P/E | 0 |

P/B | 3.07 |

Face value | ₹ 1 |

Cash | ₹ 0.15 Cr. |

Debt | 0 Cr. |

Promoter holding | 50.33% |

EPS | ₹ -0.01% |

Sales Growth | -100% |

ROE | -0.26% |

ROCE | -0.25% |

Profit growth | 66.32% |

Div yeild | 0% |

Book Value | ₹ 4.94 |

Top peers comparison of kamopaints with Market capitalization

1. Shalimar paints ltd.

- Company Market Capitalization ₹ 1138.05 Cr.

- Company specialized in manufacturing of all types of paints: interior wall, exterior wall, metal surface, wooden surface, etc.

2. Retina paints ltd.

- Company Market capitalization of ₹ 109.22 Cr.

- Company Specialized in Manufacturing of wall plates, Textures, Wallcare Distempers, cement primers.

3. Ducol organic & colour ltd.

- Company Market capitalization of ₹ 181.75 Cr.

- Company specialized in Manufacturing and supply of pastes, colourant, Masterbatches etc .

So, we discuss the competitor of kamopaints Share price target 2025.

Share price target of kamopaints ltd.

This is a weekly chart of the company. So now the question is, How do we know what charts are trying to say?

This is the overall weekly chart. So don’t confuse from charts you think share was fall from Rs 1000 to 50 rs that’s not the case, company board approves shares split in 1:10 ratio means If anybody holds 1 share of kamopaints that 1 share converted into 10 share 😄.

So why did the company approve the share split? Because the company wants liquidity in equity shares to encourage small investors to invest by making the company stock affordable.

Now come to chart 📈 analysis. In charts, price currently touches only lower low selling and consolidation. Now charts are also a little confused; buying volume has not been seen as of now. So, wait till buying volume comes; let Rs 30 per share be crossed with volume. (Caution: we are not SEBI registered advisors.)

This is all about Kamopaints Share price target 2025. Now let’s come to share the holding pattern.

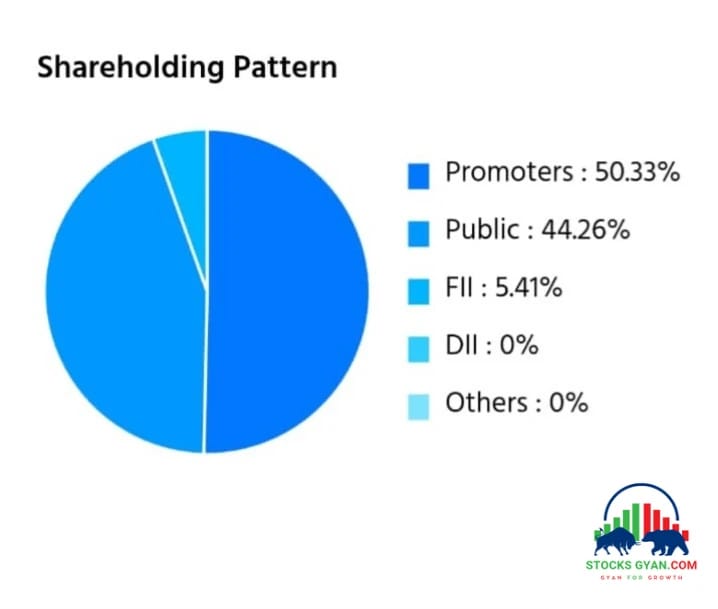

Kamopaints Shareholding pattern

- Promoters – 50.33%

- public- 44.26%

- FIIs 5.41%

- DIIs – 0%

The promoter holding of ₹ 50.33% which is good

Kamopaints Financial

profit and loss all Figures are in Cr.

Particular | MAR 2021 | MAR 2022 | MAR 2023 | MAR 2024 |

Net Sales | 0 | 0 | 8.99 | 0 |

Total Expenditure | -0.01 | 0 | 9.89 | 0.69 |

Operating profit | -0.01 | 0 | -0.90 | -0.69 |

Other income | 0 | 0 | 0 | 0.38 |

Interest | 0 | 0 | 0.05 | 0.01 |

Depreciation | 0 | 0 | 0 | 0 |

Expectional Items | 0 | 0 | 0 | 0 |

Profit before Tax | -0.01 | 0 | -0.94 | -0.32 |

Tax | 0 | 0 | 0 | 0 |

Net profit | -0.01 | 0 | -0.94 | -0.32 |

EPS | -0.25 | -0.12 | -0.03 | -0.01 |

After reading this what do you understand, Kamopaints financial was poor there was No sales at all.

Recent QTR financial was also the same, but company business was good for future growth but high-risk company. Let’s move to your favourite topic Kamopaints Share price target 2025.

Kamopaints Share price target 2025, 2030, 2040, 2050

Kamopaints Share price target years | Target 🎯 price |

2025 | ₹ 22.10 |

2026 | ₹ 30 |

2027 | ₹ 38 |

2028 | ₹ 46.59 |

2029 | ₹ 57.32 |

2030 | ₹ 60.20 |

2040 | ₹ 73.20 |

2050 | ₹ 80.45 |

So now Read the detailed analysis of Kamopaints Share price target 2025, 2030, 2040, 2050

Read also Axita cotton share price target 2025

Kamopaints Share price target 2025.

Kamopaints share price target 2025 🎯 Expected target would be Rs 26 per share. Here are some factors that influence price to achieve target 🎯 of Rs 26 per share.

The company started focusing on eco-friendly paints. As demand was increasing for environmentally friendly paints, the company also innovated many paint designs, prices, and many other things that were good for the future. 🤑

This is all about Kamdhenu ventures Share price target 2025.

| Kamopaints Share price target 2025 | Rs. |

| First Target 🎯 | 18.10 |

| Second Target 🎯 | 21.10 |

| Third Target 🎯 | 26 |

Kamopaints Share price target 2030

After 5 years, technology advancement is at its peak, so the company started focusing on technology to increase sales and Growth.Company Collaborate with construction companies; this is a good deal for the company. This can create a good influence on price that can achieve the target 🎯 of Rs 50.40 per share.

| Share price target | Rs |

| First Target 🎯 | 30.50 |

| Second Target 🎯 | 42.56 |

| Third target 🎯 | 50.40 |

Kamopaints Share price target 2040

After 15 years, we can only predict what is going to happen. In this competitive market, a company should create the best sales team to create a healthy order book if the company can do it and will in the future.In the future, Target would be Rs 73 per share.

The company has already started focusing on tech and eco-friendly products.

| Share price target | Rs. |

| First Target 🎯 | 60 |

| Second Target 🎯 | 65 |

| Third Target 🎯 | 73 |

Kamopaints Share price target 2050

After 25 years, the company can achieve the target 🎯 of Rs 80.45 per share.Company expanding production capacity and plan to expand business in foreign countries This is the latest kamdhenu ventures news.

ution We are not SEBI-registered advisors. Ask your financial advisor before investing..

| Share price target | Rs |

| First Target 🎯 | 60.25 |

| Second Target 🎯 | 77.48 |

| Third Target 🎯 | 80.45 |

Company Strength👍 and Weakness 👎

Strength

- The company has Significantly reduced items debt by 5.10 Cr.

- Company is debt free.

- Company have efficient cash conversion cycle of 0 days.

- Company has high promoter holding of 50.33%.

Weakness

- Company has Low EBITDA margin of 2% from past 5 years.

- Company has negative cash flow from operation.

- Company has poor ROCE of 3.50% over past 3 years.

- Company Shown poor profit growth -442.72% from past 3 years.

Conclusion

So, I think you understand the whole financial picture of a company, which shows poor profit growth and revenue. The product was good, but the company was not able to do good business.

So how can a company compete with big giants? A company needs good management, a marketing team, and a sales team to improve the business. This is all about Kamopaints Share price target 2025.

Happy investing 💵

FAQs

Is it good to buy kamopaints Share?

Yes, you can buy share for long term only but in limited quantity don't think about short term.

What are products of kamopaints?

Kamopaints manufacture all types of paint and also trade in TMT bars and structural steel.

Who is the owner of kamdhenu paints ?

Mr. Satish Kumar Agarwal gold medalist in B.E mech.

Disclaimer

All the information given on the website Stocksgyan.com, all news or ideas taken from a big website and presented here to add value, information, and accessibility, We are not SEBI-registered advisors.

We don’t provide fake news or fake information on our website.Please🙏 don’t buy any stocks after reading this blog. Do your own analysis. Because money is yours, profit is yours, and loss is yours..👍Happy investing😄

“Hello! I’m Harsh sahu, a seasoned blogger with over 2 years of experience in crafting engaging, SEO-optimized content. My expertise lies in creating high-quality, keyword-driven blog posts that drive traffic, boost rankings, and captivate audiences.”