Mukka Proteins Share Price Target 2025, 2030, 2040, 2050

“Fuel Your Investments: Unlocking Mukka Proteins Share price target 2025.

Hello guys 🤠 Hope you enjoyed my previous money minting articles💵🤑. Today’s topic is very insightful. We will discuss Company financials, who makes fish 🐠 protein products, and also we discuss Mukka Proteins Limited share price.

As you know, this types of products demand is increasing rapidly, so this is beneficial for company growth. The animal protein market is experiencing rapid growth driven by demands for Mukka proteins.

It is well positioned to multiply the growth. In this blog we will do a full analysis of the company Mukka Proteins Limited share price target 2025 to 2050. Now what can an investor expect from this stock? What future growth is available for this company for the first 5 years, 2025 to 2030? Without wasting your time let’s get started.

Company introduction

The company was incorporated in 2003 under the name Mukka Proteins Limited. It is a manufacturer and exporter of fish food and fish oil.

Mukka Proteins is an animal protein company engaged in the production of fish meal, fish oil, and fish soluble paste, as well as other proteins such as black soldier fly and insect meal in the animal food vertical.

Company official website link 🖇️🔗

Company manufacturing unit present in the coastal region, 10 different locations which includes Karnataka, Maharashtra, and Gujarat, as well as in the Gulf of Oman and Bangladesh total output capacity of 1 lac MT

So, let’s discuss the company in depth.

Further analysis fish oil also find some application in pharma products Omega 3. 💊 Pills and related products from fish oil .

Some facts about Company :

- 50+ years in Business

- 8+ Global Location

- 875+ Employee Base

- 63% Market Share

Exporting country – Bangladesh, chile, Indonesia, Malaysia, Myanmar,China, philipines, South Korea, Taiwan and Vietnam

The company completed its IPO in 2024, offering 8 Cr equity shares and aggregating Rs. 224 Cr, and got listed on BSE and NSE on 7 March 2024.

Currently, Mukka Proteins holds a market capitalization of ₹ 1,260 Cr. This is a small-cap company. So, I think you understand the whole company, and Mukka Proteins Limited share price is trading at ₹ 42 per share.

Now let’s move to the Mukka proteins products part, and then we move towards the Mukka proteins share price target 2025.

Mukka Proteins products

Now coming to the main point: products, because a company runs on a solid product; without a good product, a company is not able to achieve new heights. So, now the question is what types of products they sell. Let’s see.

Mukka proteins is one of the largest exporter of fish Meal and fish oil.

- Fish Meal

- Fish Oil

- Fish Soluble Paste

- Ento Meal

- Ento meal

This is all about Mukka protein products. You can visit the company’s official website to know more details about the products. Now we moving towards Mukka proteins Share price target 2025.

Market view of Mukka proteins

price Summary

- Today’s High – ₹ 42.42

- Today’s Low – ₹ 41.72

- 52 week high – ₹ 56.56

- 52 week low – ₹ 30.00

- Upper Circuit- ₹ 50.40

- Lower Circuit – ₹ 33.60

| TERMS | VALUE |

|---|---|

| Market capitalization | ₹ 1,254 Cr. |

| Enterprise Value | ₹ 1,458.33 Cr. |

| No. of Share | 30 cr |

| P/E | 37.15 |

| P/B | 3.42 |

| Face Value | ₹ 1 |

| Div Yeild | 0% |

| Book Value | ₹ 12.21 |

| Cash | ₹ 123.51 Cr. |

| Debt | ₹ 327.84 Cr. |

| Promoter holding | 73.33% |

| EPS | ₹ 1.13 |

| Sales Growth | 18.96% |

| ROE | 25.79% |

| ROCE | 18.30% |

| Profit Growth | 59.19% |

Top peer Comparison of Mukka proteins with their Market Capitalization

Read Also Integra essentia ltd share price target 2025

1. GRM overseas

- GRM Overseas holds a market capitalization of ₹ 1,326.90 Cr. and share price trading at ₹ 40 per share.

- GRM Overseas is engaging in processing branded and non-branded basmati rice in India. It also offers species, chaki fresh aata, as well as ready-to-eat biryani.

2. AVT natural Products

- AVT natural holds a market capitalization of ₹ 1,220 Cr. and share price trading at ₹ 80.05 per share.

- Avt natural products specialized in manufacturing of plant extracts and natural ingredients solution for food and beverages.

3. Sarveshwar foods

- Sarveshwar foods holds a market capitalization of ₹ 1,007.20 Cr. and share price trading at ₹10.20 per share.

- This company is based in Jammu & Kashmir, engaging in the processing of basmati rice 🍚🌾 in branded and unbranded foam.

This is all about competitors. Now we are slowly moving towards Mukka Proteins share price target 2025 to 2050. Read carefully and understand the company first.

Share price chart of Mukka proteins

As you know, this is a share chart 📉📈. So, the first chart is the live TradingView daily timeframe chart you can scroll to see previous days prices, and the second chart is the weekly timeframe chart. So how do we know what charts are saying?

Let’s discuss one by one, starting with the daily chart. So in daily charts, what chart are they trying to say?As I see the daily charts, Mukka share price is consolidating near ₹40 to ₹43 per share.

If the price crosses ₹45 per share with volume, then we expect some fireworks 🎆, meaning the share can give 20% to 30% gain in the short term. If the price breaks ₹40 some selling pressure can be seen, but the price is taking support on 20 EMA, so please keep watching the 20 EMA on the daily chart.

So, Mukka Proteins share price target for the short term is around ₹56.09 per share, and if selling happens, the stock can touch ₹32 per share.

Now coming to weekly charts First, why a weekly chart? Because the company got listed in 2024, so there is not much price data available; that’s why we choose weekly charts 🎯💵.💵

In charts there is limited data available. Share got listed in March, so share consolidation is in the range of ₹30 to ₹40. The share got listed at ₹41 per share, and after 3 months, the price touched the low of ₹30.

After that, the price gives a breakout in July and touches the high of ₹ 56 per share and again falls to ₹ 38 per share in September 2024, and now the price is consolidating.

As per the chart analysis, the price can touch the swing high of ₹ 56 per share, which means a 25% to 30% gain in the coming months.

Now we moving towards Company share holding pattern after that we discuss Mukka proteins Share price target 2025 to 2050.

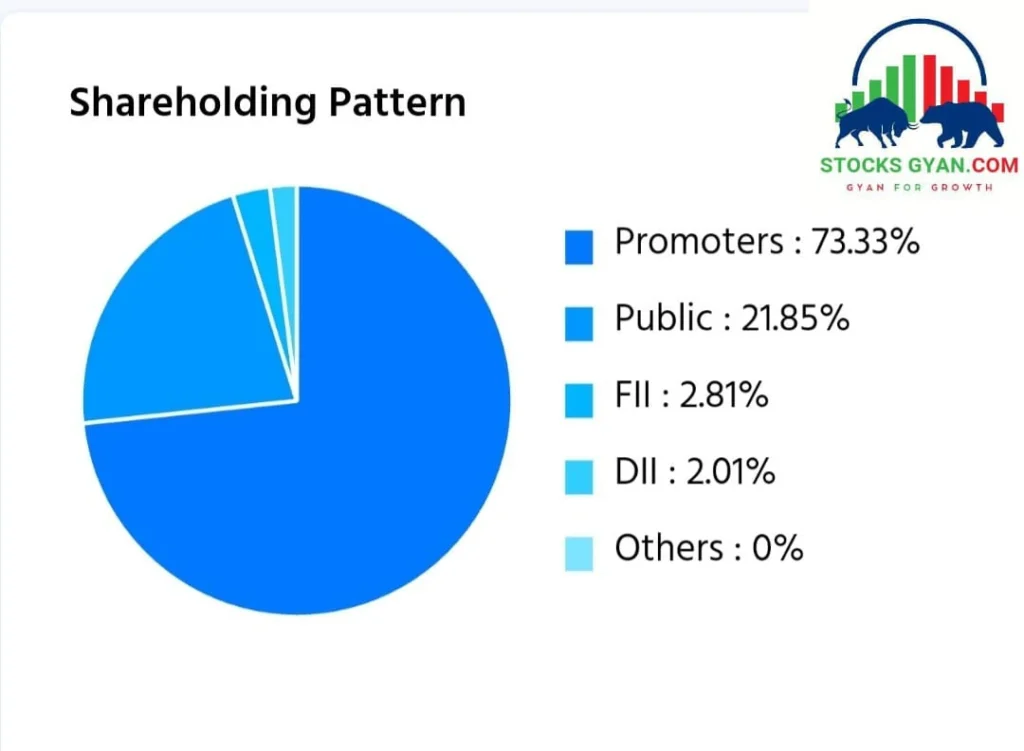

Mukka proteins Share holding pattern

- Promoters – 73.33%

- Public – 21.85%

- FIIs – 2.81%

- DIIs – 2.01%

Company with highest promoter holding 73.33% this is good👍 for Company fundamental.

Mukka proteins financial

All profit and Loss figures are in Cr.

Particular | MAR 2021 | MAR 2022 | MAR 2023 | MAR 2024 |

Net Sales | 536.25 | 692.89 | 1,066.40 | 1,268.54 |

Total Expenditure | 529.39 | 660.37 | 1,000.73 | 1.187.17 |

Operating profit | 6.86 | 32.52 | 65.67 | 81.39 |

Other income | 9.15 | 7.74 | 8.87 | 20.08 |

Interest | 6.95 | 8.35 | 15.18 | 24.20 |

Depreciation | 3 | 3.72 | 4.27 | 5.62 |

Expectional Items | 0 | 0 | 0 | 0 |

Profit before Tax | 6.06 | 28.20 | 55.10 | 71.65 |

Tax | 1.45 | 8.38 | 15.67 | 8.89 |

Net profit | 4.61 | 19.82 | 39.42 | 62.76 |

EPS in Rs | 0.21 | 0.90 | 1.79 | 2.09 |

So, you read the financials of the company. What do you think 🤔? Can the company be able to give a multifold🤑 return in the coming years?

Now let’s discuss recent financial results. Company reported quarterly net profit of ₹ 2.08 Cr. In September 2024, down 92.64% from ₹ 28.27 Cr in September 2023. EBITDA reported ₹ 12.71 Cr in September 2024, down by 70% from ₹ 42 Cr. In September 2023, EPS was also down to ₹0.07 from ₹1.29.

Quarterly result was very Poor you should avoid this share now please wait till Next quarter result we will update in our website.

Mukka proteins Share price target 2025, 2030, 2040, 2050

| Target 🎯 Years | Share price target |

|---|---|

| 2025 | 67.90 |

| 2026 | 84.70 |

| 2027 | 98.10 |

| 2028 | 115.65 |

| 2029 | 130.40 |

| 2030 | 190.20 |

| 2040 | 299.50 |

| 2050 | 520.49 |

So now discuss the Minimum and Maximum share price target. 💵

Mukka proteins Share price target 2025 💵

| Months | Targets 🎯 |

|---|---|

| January | 45.80 |

| February | 44.20 |

| March | 47.80 |

| April | 49.10 |

| May | 50.10 |

| June | 53.40 |

| july | 54.20 |

| August | 52.80 |

| September | 58 70 |

| October | 65.70 |

| November | 65.10 |

| December | 60.10 |

Mukka proteins Share price target 2026 💵

| Months | Targets 🎯 |

|---|---|

| January | 61.20 |

| February | 65.80 |

| March | 67.90 |

| April | 70.10 |

| May | 72.50 |

| June | 73.80 |

| July | 76.80 |

| August | 78.15 |

| September | 80 .40 |

| October | 81.90 |

| November | 82.30 |

| December | 82.50 |

Mukka proteins Share price target 2027 💵

| Months | Targets 🎯 |

|---|---|

| January | 80.10 |

| February | 81.50 |

| March | 86.80 |

| April | 89.20 |

| May | 93.10 |

| June | 94.10 |

| July | 96.20 |

| August | 98.10 |

| September | 97.10 |

| October | 90.35 |

| November | 93.30 |

| December | 95.90 |

Mukka proteins Share price target 2028 💵

| Months | Target 🎯 |

|---|---|

| January | 98.10 |

| February | 105.55 |

| March | 110.10 |

| April | 101.10 |

| May | 98.35 |

| June | 95.20 |

| July | 107.10 |

| August | 108.45 |

| September | 109.65 |

| October | 112.30 |

| November | 115.10 |

| December | 114.10 |

Mukka Proteins Share price target 2029 💵

| Months | Targets 🎯 |

|---|---|

| January | 120.50 |

| February | 130.40 |

| March | 132.80 |

| April | 110.50 |

| May | 105.70 |

| June | 106.20 |

| July | 115.80 |

| August | 120.50 |

| September | 130.60 |

| October | 129.80 |

| November | 125.20 |

| December | 130.40 |

MK proteins Share price Target 2030 💵

| Months | Targets 🎯 |

|---|---|

| January | 131.20 |

| February | 136.80 |

| March | 135.60 |

| April | 140.20 |

| May | 160.50 |

| June | 120.60 |

| July | 125.70 |

| August | 140.60 |

| September | 150.80 |

| October | 167.80 |

| November | 190.80 |

| December | 170.70 |

This is all about MK proteins Share price target 2030 this is only forecast according to technical and fundamental analysis please track company financial performance every quarter because recent poor financial then do your own research then invest.

Mukka Proteins Strength 👍 and Weakness 👎

Strength

Read also Rajnandini metal share price target 2030

- Company shown good profit growth of 138% for past 3 years.

- The company shown a good Revenue Growth of 33.35% for past 3 years.

- Company ha high promoter holding of 73.33%.

- The Company has healthy cash conversion cycle of 78 days.

Weakness

- Company has negative cash flow from operation.

- Tax rate is low at 12.40

- Company posted very poor quarterly results.

Company Annual report and Credit rating Link 🔗

This is Annual report you can download this by one click So, I think you understand the Mukka proteins Share price target 2025

Conclusion

In short, we discussed many things about the company to determine Mukka Proteins share price target 2025 to 2050. companies with highest promoter holding.

The company posted a very poor result in the recent quarter. So, track company financial performance every quarter. If you want to invest, we will update you on our website every quarter.

If you see financial and business was improving, then only you invest. That’s all for today’s topic Mukka proteins limited share price target 2025.

FAQs

What are the products of mukka proteins?

Mukka proteins is a good player in animal protein industry specialized in production of fish Meal, fish oil, fish soluble paste.

What is the target price of mukka proteins near short term ?

If company share price cross ₹44 per share with volume then Mukka proteins can gives 30% return in short term.

What is the price target for Mk proteins in 2025?

Price can touch Rs 65 per share by year ending 2025.

Disclaimer

Mukka proteins limited share price target 2025 All the information given on the website Stocksgyan.com, all news or ideas taken from a big website and presented here to add value, information, and accessibility, We are not SEBI-registered advisors.

Stocksgyan.com We don’t provide fake news or fake information on our website. Please don’t 🙏 buy any stocks after reading this blog. Do your own analysis. Because money is yours, profit is yours, and loss is yours..👍Happy investing😄

“Hello! I’m Harsh sahu, a seasoned blogger with over 2 years of experience in crafting engaging, SEO-optimized content. My expertise lies in creating high-quality, keyword-driven blog posts that drive traffic, boost rankings, and captivate audiences.”