Ashoka Metcast Share price target 2025, 2030, 2040, 2050

Ashoka metcast share price target 2025, Hello friends 👋😀 A warm welcome to our next article! Hope you are doing well; today’s topic is from the steel sector. As you know, infrastructure development is at its peak, so this type of product demand is increasing rapidly.

In this article we discuss the company introduction, share price target, product and services details, and many more things.

So read this article in full, focused on becoming a great investor. 💵 Because without knowing a company, you can’t make money. Ashoka Metcast is slowly establishing its name, but can this company be able to compete with big giants?

How do we know what future is left behind Ashoka metcast? What does the future hold for this company in 2025, 2030, 2040, and 2050?

So my dear learners, Let’s get started with an introduction and become a great investor by selecting good stocks for your portfolio.

Company introduction

Ashoka Metcast Share is a steel trading company. This company is slowly establishing its name by doing good business. The government is putting billions of dollars into infrastructure development, which is good for the steel sector.

Ashoka Metcast (AML) is a part of a Gujarat-based diversified business. This group is currently promoted by Mr. Shalin Ashok Shah and family. This company is currently manufacturing structural steel products like TMT bars, angle channels, MS bars, etc.

Company official website link 🖇️

This company is in the steel trading business. Ashoka Metcast leverages its groups and promoter networks in the real estate and infrastructure space. The company is trading at Rs 23 per share and holds a market capitalization of Rs 56.32 Cr.

Now let’s come to the products and services part, and then we move to the Ashoka Metcast share price target from 2025 to 2050.

Ashoka metcast product & services

Company is engaged in steel trading business let’s discuss Company product What types of products they Manufactured .

- TMT bars

- Angles

- MS bars

- Channels

I think you all know about this product so without wasting your time we directly come to topic.

Market view of Ashoka metcast (Steel Trading business)

price summary

- Today’s high – ₹ 22.79

- Today’s low – ₹ 21.81

- 52 week high – ₹ 35.70

- 52 week low – ₹ 16.52

| TERMS | VALUE |

| Market Capitalization | ₹ 56.32 Cr. |

| Enterprise value | ₹ 56.06 Cr. |

| No. Of share | 2.50 Cr |

| P/E | 20.32 |

| P/B | 1.47 |

| Face Value | ₹ 10 |

| Div yeild | 0% |

| Book value | ₹ 15.35 |

| Cash | ₹ 0.25 Cr. |

| Debt | ₹ 0 Cr |

| Promoter holding | 53.65% |

| EPS | ₹ 1.11 |

| Sales Growth | – 44.67% |

| ROE | 2.72% |

| ROCE | 3.45% |

| Profit Growth | 910.07% |

Top Peer Comparison of Ashoka metcast with their market capitalization

Read Also Fineotex chemical Share price target 2025

1. BMW Industries Ltd.

- BMW Industries holds a market capitalization of Rs 1,182.25 Cr. Share price trading at Rs 52.

- BMW Industries Specialized in Manufacturing processing of Steel products GP coil, GP sheets, TMT rebars, GI pipes, etc.

2. Aerpace Industries Ltd.

- Aerpace Industries holds a market Capitalization of Rs 542.81 Cr. Share price Trading at Rs 36.00

- Aerspace Industries Specialized in Trading of Steels but now shifted to develop all electric air mobility transportation system.

3. Sharda Ispat Ltd.

- Sharda Ispat holds a market capitalization of Rs 162.36 Cr. And Share price trading at Rs 320.

- Sharda Ispat specialized in manufacturing of alloy steel flat rolled products.

So, In this part we discussed Competitor of Ashoka metcast share price target 2025.

Share price chart of Ashoka metcast ltd.

What charts are trying to Say?

So, the first chart is the daily live TradingView chart, and the second chart is weekly charts. The weekly chart is showing some graph in the bottom, called volume.

Now let’s discuss the weekly chart because for long-term Target required long time frame charts 🎯.

First, discuss the overall chart. June 2023 chart is in the range of Rs 16 per share to Rs 34 per share. No buying seen as of now, On the December 2023 chart, give a breakout above Rs 24 per share and price touch the next all-time high of Rs 34 per share. After that, share fell to Rs 18 per share, then price continuously consolidating in September 2024 again, price touched the 52-week high.

So now discuss the short-term target for the steel trading company.

In daily chart, not clear chart 📉 as of now. According to my analysis, the short-term price can fall to Rs 20 per share, then it will consolidate because share demand is very low.

On weekly charts basic, price and volume showed mixed data, but selling volume was high, as you see in the bottom of the 📈 graph. This is a penny stock; you only buy this stock for long-term only. Avoid for short-term Target 🎯.

In the next part, we will discuss Ashoka Metcast Limited Share Price.

Ashoka metcast share technical {Buy or Sell}

You may still be confused about whether this is a buying level. current share price is at a support level, and the monthly RSI is at 54.18. For investment purposes, consider starting to buy at this level in limited quantities, with a short-term target of Rs 30 per share.

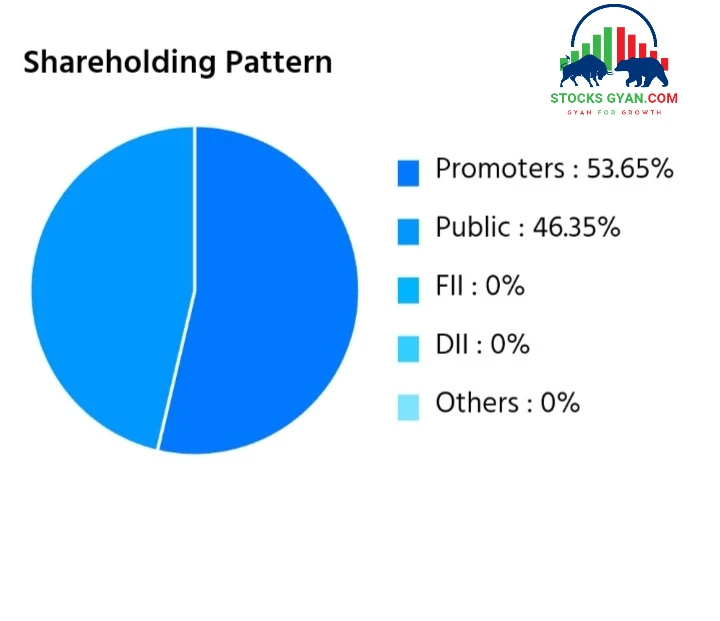

Ashoka metcast share holding pattern

- Promoters – 53.65%

- Public – 46.35%

- DIIs – 0%

- FIIs – 0%

Promoter are holding majority without pledging any share this is for Ashoka metcast share price to reach high.

Ashoka Medcast Financial

profit and Loss all figures are in Cr.

Particular | MAR 2021 | MAR 2022 | MAR 2023 | MAR 2024 |

Net sales | 54.30 | 67.03 | 50.44 | 66.25 |

Total Expenditure | 52.54 | 62.66 | 45.98 | 59.24 |

Operating profit | 1.76 | 4.37 | 4.46 | 7.01 |

Other income | 0.04 | 0.31 | 0.75 | 1.75 |

Interest | 0.98 | 1.27 | 0.72 | 1.53 |

Depreciation | 0.64 | 0.64 | 0.43 | 0.74 |

Expectional Items | 0 | 0 | 0 | 0 |

Profit before Tax | 0.18 | 2.77 | 4.06 | 6.49 |

Tax | 27.78% | 19.14% | 24.14% | 26.04% |

Net profit | 0.15 | 2.35 | 3.22 | 4.79 |

EPS in Rs. | 0.14 | 1.19 | 1.29 | 1.92 |

So , I think you understand the financial Slowly company Growth was improving. What do you think Ashoka metcast share price can give multibagger return in coming years?

Now let’s discuss Ashoka’s recent financial result for Q2 2025. Total revenue was up by 665% to Rs 7.01 million, and revenue was Rs 1.02 million during the similar quarter of the previous year. Net profit is Zoomed to 994.87% from Rs 0.78 million to Rs 8.54 million; operating profit quarter ended September 2024 rose to 9.34 million as compared to 0.97 million of corresponding quarter ended September 2023.

Financials are telling us that something big is cooking in the company, but there is no strength in the stock price.

So, if company financials are continuing to grow, then we will see some kind of strength in stocks. Keep in mind that Ashoka is in the steel trading business.

This is all about Ashoka metcast share price target 2025 Financial.

Ashoka Medcast Share price target 2025, 2030, 2040, 2050

| Targeting Years | Target Rs. |

|---|---|

| 2025 | 30.60 |

| 2026 | 32.20 |

| 2027 | 43.50 |

| 2028 | 55.40 |

| 2029 | 62.80 |

| 2030 | 78.20 |

| 2040 | 120.70 |

| 2050 | 150.90 |

So, Here are the Minimum and Maximum Target price 💵

Ashoka metcast Share price target 2025 💵

| Months | Targets Rs |

|---|---|

| January | 20 |

| February | 29.90 |

| March | 32.80 |

| April | 26.70 |

| May | 29 |

| June | 31.70 |

| July | 32.70 |

| August | 33.30 |

| September | 34.80 |

| October | 32.90 |

| November | 33.60 |

| December | 30.00 |

According to research, the outlook for the steel trading business is expected to grow 8% annually, driven by strong infrastructure investment, but many big companies are there. So, the company should focus on strong sales with strategy.

Ashoka metcast share price target 2026 💵

| Months | Target |

|---|---|

| January | 35.80 |

| February | 34 |

| March | 36.20 |

| April | 34.90 |

| May | 35.30 |

| June | 36.40 |

| July | 38.20 |

| August | 36.30 |

| September | 34.50 |

| October | 32.80 |

| November | 33.70 |

| December | 32.60 |

Ashoka metcast share price target 2027 💵

| Months | Target |

|---|---|

| January | 41.60 |

| February | 42.49 |

| March | 43.90 |

| April | 43.20 |

| May | 44.10 |

| June | 45.20 |

| July | 45.80 |

| August | 47.80 |

| September | 48.30 |

| October | 46.20 |

| November | 48.50 |

| December | 49 |

Ashoka Medcast Share price target 2028 💵

| Months | Target Rs |

|---|---|

| January | 49.20 |

| February | 50. 40 |

| March | 51.20 |

| April | 51 20 |

| May | 55.80 |

| June | 54.40 |

| July | 49.10 |

| August | 50.90 |

| September | 52 |

| October | 52 |

| November | 54.20 |

| December | 53.50 |

Ashoka metcast share price target 2029 💵

| Months | Target Rs |

|---|---|

| January | 52.90 |

| February | 54 |

| March | 55.90 |

| April | 51.70 |

| May | 55.20 |

| June | 56.40 |

| July | 56.60 |

| August | 57 |

| September | 59.80 |

| October | 61.20 |

| November | 56.70 |

| December | 60.80 |

Ashoka Medcast Share price target 2030 💵

| Months | Target Rs |

|---|---|

| January | 62 |

| February | 65.70 |

| March | 63.10 |

| April | 65.60 |

| May | 64.40 |

| June | 67.80 |

| July | 68.10 |

| August | 70.20 |

| September | 65.80 |

| October | 72.60 |

| November | 75.60 |

| December | 76.80 |

The company can achieve these targets, but the company should focus on profitability because once profitability increases, the company can easily expand the business.

As an investor, you should keep a bird’s-eye 👀 view on company financial performance and market trends to predict stock price for future prospects.

This is all about Ashoka Metcast share price target 2025 to 2050. Now discuss company strengths and weaknesses.

Ashoka metcast Strength 👍 and weakness 👎

Strength

Read also Axita cotton share price target 2025

- Company is virtually Debt free.

- Company PEG ratio is 0.02.

- Company has high promoter holding of 53.65%.

- Company has posted good profit growth of 39% CAGR over last 5 years.

Weakness

- Promoter holding is decreased over last quarter -1.58%.

- The company has trading at a high PE of 21.70.

- The Company has Low EBITDA margin.

Conclusion

So, Friends How’s the article? I think you enjoyed a lot and gained knowledge about the Ashoka Metcast share price target for 2025. As you know, Ashoka metcast is In the steel trading business, steel demand is increasing as infrastructure projects are running.

If the company put more focus on profit margin, it would boost company profit. Now ask yourself, Can I invest money 🤑💵 in this company?

Company important Download links

FAQs

Is Ashoka metcast share good to buy in 2025?

Yes, you can buy this share in 2025 for long term only .

What are the products of Ashoka metcast limited?

Ashoka is primarily engaged in manufacturing and trading business of TMT bars channels etc.

Who is the owner of Ashoka metcast?

This company is owned by Mr. Shalin Ashok Shah and family.

Disclaimer

All the information given on the website Stocksgyan.com, all news or ideas taken from a big website and presented here to add value, information, and accessibility, We are not SEBI-registered advisors.

We don’t provide fake news or fake information on our website.Please🙏 don’t buy any stocks after reading this blog. Do your own analysis. Because money is yours, profit is yours, and loss is yours..👍Happy investing😄

“Hello! I’m Harsh sahu, a seasoned blogger with over 2 years of experience in crafting engaging, SEO-optimized content. My expertise lies in creating high-quality, keyword-driven blog posts that drive traffic, boost rankings, and captivate audiences.”