Hindcon Chemicals Share price target 2025, 2030, 2040, 2050

Hindcon Chemicals Share price target 2025, Once again, we welcome you all in our blog for your betterment of your investment journey.I hope you are reading my all-money minting 💵 blog.

Let’s again discuss the chemical sector, but with different Stock. Let’s Start. As you all know, the chemical sector is growing rapidly because in all products like foods, medicine, hygiene items, cosmetics, construction items, etc., chemicals are used.

Imagine a future where chemicals transform industries. Hind Chemicals Ltd. has been consistently delivering strong financial performance driven by its unique product.

As we look ahead to 2025, we expect Hindcon Chemicals to continue its growth momentum driven by increasing demand for chemicals. Hind Chemicals Ltd. has established itself as a leading player in construction chemical products. What does the future hold for this company in 2025, 2030, 2040, and 2050.

So, my dear learners Let’s get started to become great investors 💵 by selecting good stocks.We start with a business introduction, then we move towards Hindcon Chemicals share price target of 2025.

Introduction

In the beginning, Hindcon Chemicals Limited was incorporated as a private limited company named Hind Silicates in 1998. After that, the company name changed to Hindcon Chemicals Private Limited in 2010.

Company official website Link 🔗

As you know, construction space is evolving like a rocket. So companies know about the construction sector, so then they pick up a small idea 💡 of chemicals, and the rest is history. Company has 25+ years experience in construction chemical corporations.

The company is well positioned and set to become a great company, but how does the company deal with or compete with a big competitor?

What can any investor expect from the construction chemical company? Let’s discuss this and the company’s business model. After that, we come to your favorite topic. Hindcon Chemicals Share price target 2025 to 2050.

Hind Chemicals Ltd. Share Price Currently trading at Rs 40.92 per share and holding a market capitalization of Rs 209.47 Cr. This is a small cap. Hindcon Chemicals has an all-inclusive range of construction chemicals and additives, and the company offers cement additives, concrete, mortar admixture, flooring, foundry aids, and coating products.

Company products were well diversified, which is good for future growth.

Hind Chemicals Ltd products

Hind Chemicals Ltd. deals in diversified products in construction chemicals and cement additives. This company has 25 years of experience in this field.

Recently, Hindcon is an active member of an Indian green building council company actively working on green chemical products, which means doing R&D.

Let’s discuss the construction chemical list.

1. Sodium silicate product.

- Sodium Silicate (Alkaline)

- Sodium Silicate (Neutral)

2. Cement additive product

- Waterproofing compound

- Concrete mortar admixture

- Concreting Aid

- protective coatings and sheeting

- Grouts

- Epoxy grout and mortar

- Flooring• Shortcut Aid

- Sealent

- Tile Adhesives

- Remover and cleaning compound

- Foundry aid

- Evacuation Aid

- Expansion contraction join

- Green product

- Grinding Aid

- Coating: impregation

3. Multi-Safe product

- Floor cleaner (wide range)

- Rust Remover

- Tap and shower cleaner.

Services

- Waterproofing and repair service

- Retrofitting and restructuring Service

This is all about construction chemical products. Now moving Hindcon Chemicals Ltd share price.

Market View of Hind Chemicals Ltd

price Summary

- Today’s high – Rs 41.30

- Today’s Low – Rs 40.30

- 52 week high – Rs 62.70

- 52 week low – Rs 38

| TERMS | VALUE |

|---|---|

| Market Capitalization | Rs 209.47 Cr. |

| Enterprise value | Rs 198.04 Cr. |

| No. of share | 5.12 Cr. |

| P/E | 41.08 |

| P/B | 4.22 |

| Face value | Rs 2 |

| Div yeild | 0.36% |

| Book value | Rs 9.69 |

| Cash | Rs 11.44 Cr. |

| Debt | Rs 0 Cr |

| promoter holding | 68.64% |

| EPS | Rs 1 |

| Sales Growth | -24.47% |

| ROE | 14.76% |

| ROCE | 19.56% |

| Profit Growth | 48.13% |

Top Peers Comparison of Hindcon Chemicals with Market capitalization

Read Also Vikash ecotech Share price target 2050

Here are the top 3 Competitor of hindcon chemicals with market capitalization.

- Hold a market capitalization of Rs 3,286.01 Cr.

- Fineotex chemical is specialized in manufacturing of Textile chemicals, Paints chemical, construction Chemical, etc.

2. Hind organic chemicals Ltd

- Hold a market Capitalization of Rs 288.31 Cr.

- Hind organic chemical is Specialized in manufacturing of basic essentials chemicals, rubber chemical, drugs , pesticides etc

3. Par drugs and Chemicals

- Hold a Market Capitalization of Rs 234.08 Cr.

- par drugs is specialized in manufacturing and exporting of Mangnisum Salts, Aluminium Salts, Silicates etc.

So, This is all about competitor and we moving towards to Hindcon Chemicals share price target 2025

Share price Chart of Hindcon Chemicals

So, without wasting time, let’s come to the point. This is the daily chart of Hindcon Chemicals Ltd. share price. What do you understand by seeing the chart?

Let’s discuss. As you see in charts On December 2023, the price was given to break out above Rs 37 per share to Rs 70 per share in 5 days after that share continuously consolidated for a long time.

In November 2024, the price touched a low of Rs 39 per share. After that, the price touched high of Rs 60 per share. But this time buying volume was good for the short term and long term Target price .

Price can touch the 52-week high. Hindcon Chemicals share price today trading at Rs 55 per share. Hindcon Chemicals has to power to become multibagger 🤑💵 in coming years.

Hindcon chemical technical {Buy or Sell}

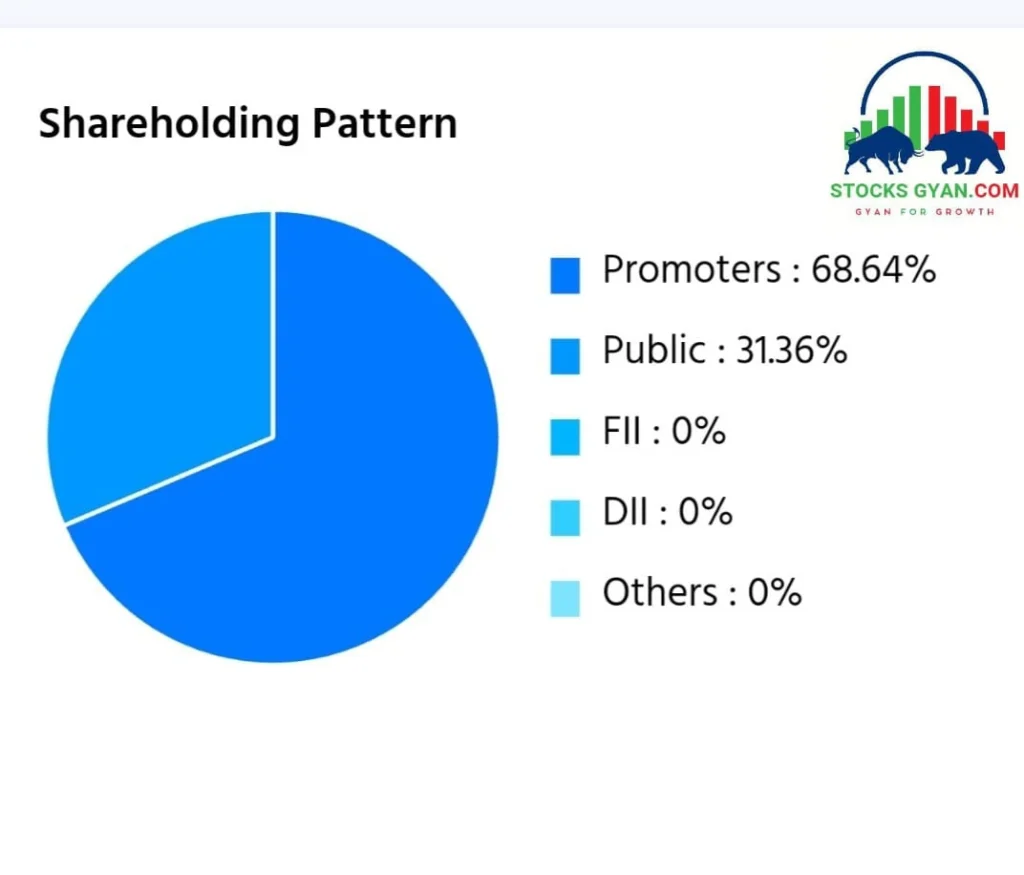

Hindcon Chemical Share holding pattern

- Promoters – 68.64%

- Public – 31.36%

- FIIs – 0%

- DIIs – 0%

promoters are holding majority of the company this is good fundamentals.

Hindcon Chemicals Financial

profit and loss all Figures are in Cr.

Particular | MAR 2021 | MAR 2022 | MAR 2023 | MAR 2024 |

Net Sales | 44.27 | 63.70 | 81.65 | 61.67 |

Total Expenditure | 39.67 | 58.76 | 76.50 | 54.52 |

Operating profit | 4.60 | 4.95 | 5.15 | 7.15 |

Other income | 2.02 | 1.59 | 1.07 | 1.75 |

Interest | 0.08 | 0.02 | 0.05 | 0.08 |

Depreciation | 0.18 | 0.25 | 0.29 | 0.35 |

Expectional Items | 0 | 0 | 0 | 0 |

Profit before Tax | 6.35 | 6.26 | 5.89 | 8.48 |

Tax | 1.61 | 1.53 | 1.58 | 2.09 |

Net profit | 4.72 | 4.74 | 4.31 | 6.38 |

Adjusted EPS | 0.93 | 0.92 | 0.84 | 1.25 |

So, you Read the Hind chemicals Ltd, What do you think 🤔 Hindcon Chemicals can give good returns in future?

Now discuss Recent Result of Q2 Hindcon Chemicals Revenue is Rs 14 Cr -19% from previous year, and Net profit is. Rs 1 Cr which is 30% down from previous year.

Revenue for the quarter ended December 2024 is Rs 152.70 million, reflecting a 13.63% increase, while profit is Rs 13.72 million, up by 15.75%.

Hindcon Chemicals Share price target 2025, 2030, 2040, 2050

| Target Years | Target Rs. |

|---|---|

| 2025 | 60.20 |

| 2026 | 70.80 |

| 2027 | 89.72 |

| 2028 | 98.45 |

| 2029 | 90.20 |

| 2030 | 103.87 |

| 2040 | 145.60 |

| 2050 | 220.70 |

So here are we discuss monthly Minimum and Maximum target 🎯

Hindcon Chemicals share price target 2025

| Months | Target 🎯 |

|---|---|

| January | 35 |

| February | 39 |

| March | 42 |

| April | 40 |

| May | 47 |

| June | 43 |

| july | 45 |

| August | 48 |

| September | 55 |

| August | 52 |

| November | 59 |

| December | 54 |

Hindcon Chemicals share price target 2026

| Months | Target 🎯 |

|---|---|

| January | 50 |

| February | 45 |

| March | 52 |

| April | 58 |

| May | 60 |

| june | 61 |

| July | 70 |

| August | 72 |

| September | 68 |

| October | 75 |

| November | 62 |

| December | 68 |

Hindcon Chemicals share price target 2027

| Months | Target 🎯 |

|---|---|

| January | 72 |

| February | 75 |

| March | 80 |

| April | 90 |

| May | 92 |

| June | 88 |

| July | 93 |

| August | 82 |

| september | 81 |

| October | 86 |

| November | 89 |

| December | 89 |

Hindcon Chemicals share price target 2028

| Months | Target |

|---|---|

| January | 95 |

| February | 88 |

| March | 90 |

| April | 92 |

| may | 93 |

| June | 98 |

| July | 98.50 |

| August | 95 |

| September | 92 |

| October | 94 |

| November | 98 |

| December | 97 |

Hindcon Chemicals Share price target 2029

| Months | Target |

|---|---|

| January | 103 |

| February | 100 |

| March | 92 |

| april | 90 |

| May | 89 |

| June | 88 |

| July | 80 |

| August | 84 |

| September | 89 |

| October | 88 |

| November | 90 |

| December | 80 |

Hindcon Chemicals share price target 2030

| Months | Target 🎯 |

|---|---|

| January | 78 |

| February | 80 |

| March | 85 |

| April | 84 |

| May | 85 |

| June | 90 |

| July | 99 |

| August | 103 |

| September | 110 |

| October | 105 |

| November | 108 |

| December | 112 |

Company Strength 👍 and Weakness 👎

Strength

Read Also Kamo paints Share price target 2025

- The Company is Significant decreased its debt by 0.98 Cr.

- Company is virtually debt free.

- The company has high promoter holding of 68.64%.

- Company has healthy interest coverage ratio of 113.13.

Weakness

- The company has shown poor Revenue Growth of 11.68% for past 3 years.

- The company is trading at high PE of 58.18.

Conclusion

So, you understand the whole company, like financials, share holding pattern, share price target, products & services, etc. Please understand company once more because you put your hard-earned money 🤑 in share personally. I feel this share is good for the long term only. Take a smart decision.

FAQs

Is Hindcon Chemicals is good stocks to buy for long term ?

yes, this stock is good for long term because company is in good sector and product was future oriented.

Can I invest money in Hindcon Chemicals for short term?

No, you can't put money for short term in any stocks without experience if you have experience then you go with stoploss

Disclaimer

All the information given on the website Stocksgyan.com, all news or ideas taken from a big website and presented here to add value, information, and accessibility, We are not SEBI-registered advisors.

We don’t provide fake news or fake information on our website. Please🙏 don’t buy any stocks after reading this blog. Do your own analysis. Because money is yours, profit is yours, and loss is yours..👍Happy investing😄

“Hello! I’m Harsh sahu, a seasoned blogger with over 2 years of experience in crafting engaging, SEO-optimized content. My expertise lies in creating high-quality, keyword-driven blog posts that drive traffic, boost rankings, and captivate audiences.”