Rtnpower Share price target 2025, 2030, 2040, 2050

Hello friends! A warm welcome to my website, Stocksgyan.com, to become an expert in the stock market. So friends, today we will discuss about Rtnpower share price target 2025 to 2050, fundamentals and financials also we discuss in this article.

So read the full article to know more. As you know, the India power sector is increasing rapidly, so if you invest in this sector for the long term, you mint money like anything.

So read this full article to know your answer to your question, Should I Invest in Rattanindia Power?😆 I can read your mind.😄

Let’s come to the topic. Rattan power share price target 2025

Company Introduction

Let’s start Rtnpower share price target 2025. This company is small-cap, holding a market capitalization of ₹ 6,062.85 Cr. and currently price trading at ₹ 11.25 per share.

What are you thinking? Let’s Invest 😜😆. Wait Wait! Read company details and financials first, then we go to Rtnpower share price target 2025.

Rattanindia Power Limited is one of the largest private power generation companies with an installed capacity of 2,700 megawatts.

Rattan India power Share price target 2025 click here to visit company official website

- 1350 MW in Amravati

- 1350 MW in Nashik

Amravati plant is one of the best performing plants in Mumbai and achieved 80% of plant load factor. The company focuses on producing power from thermal energy and coal-based power.

Also, the company started focusing on green energy generation. In aggregate, the company has paid ₹ 3,671 crore . in principal and interest since January 2020.Company is competing with many big giants.

Rtnpower Product and Services

Company engaged in the business of power generation: thermal-based power and coal-based power. Recently, a company announced to enter into green energy. Rattanindia Power operates in power generation, transmission, and distribution.

The company’s top product is

- Solar power Plants

- hydropower Plants

- Wind power plants

Recently, the company acquired Revolt Motors to sell electric vehicles. After reading the business introduction and product, don’t be in a hurry to invest. Don’t put your hard-earned money in stocks without knowledge. Let’s discuss the market overview.

Market view of Rattan power

Price summary

- Today’s High – ₹ 11.40

- Today’s Low – ₹ 11.18

- 52 week high – ₹ 21.10

- 52 week low – ₹ 7.90

| TERMS | VALUE |

|---|---|

| Market capitalization | ₹ 6,062 Cr. |

| Enterprise value | ₹ 9,147 Cr. |

| No. of Shares | 537.01 Cr. |

| P/E | 0 |

| P/B | 1.3 |

| Face Value | ₹ 10 |

| Cash | ₹ 461.59 Cr. |

| Debt | ₹ 3,546.60 Cr. |

| Promoter Holding | 44.06% |

| EPS | ₹ -1.87 Cr. |

| Sales Growth | 4.11% |

| ROE | -20.18% |

| ROCE | -5.46% |

| Div yeild | 0% |

| Book Value | ₹ 8.69 |

| Profit Growth | -409% |

Top peer Comparison of Rattan power with their approx Market capitalization.

Read also Rajnandini metal share price target 2030

Here are the top 3 Competitor of Rattan power and Market Capitalization.

1. Reliance power

- Hold a market capitalization of ₹ 16,798 Cr.

- Company is specialized in Constructing a power plants project and Generate power.

2. Inox Wind Energy

- Hold a market capitalization of ₹ 10,897 Cr.

- Company Specialized in Manufacturing of Wind turbine Generator, and Generate Green power.

3. Adani power ltd.

- Hold a market Capitalization of ₹ 1,90,513 Cr.

- Company Specialized in Generating thermal power with a Capacity of 15,250 MW

This is all about competitor. Read article carefully let’s move towards Rtnpower share price target 2025. 💵📈

Share price Chart of Rattan power

This is the monthly chart of stock Now the question is what chart is saying?

In 2023, the stock touched the low of Rs 3 per share and touched high around Rs 21 per share, then the company fell to Rs 12 per share; buying has not seen yet.

As per the rattan power chart, the company share price can touch Rs 8 per share, and then the share price can increase. Demand is not 🚫 in the charts. This is All about Rtnpower share price target 2025.

Promoter pledging %

| Date | Promoter % | Pledging% |

|---|---|---|

| Dec 2024 | 44.06 | 88.65 |

| Sep 2024 | 44.06 | 88.65 |

| Jun 2024 | 44.06 | 88.65 |

| Mar 2024 | 44.06 | 88.65 |

| Dec 2023 | 44.06 | 88.65 |

| Sep 2023 | 44.06 | 88.65 |

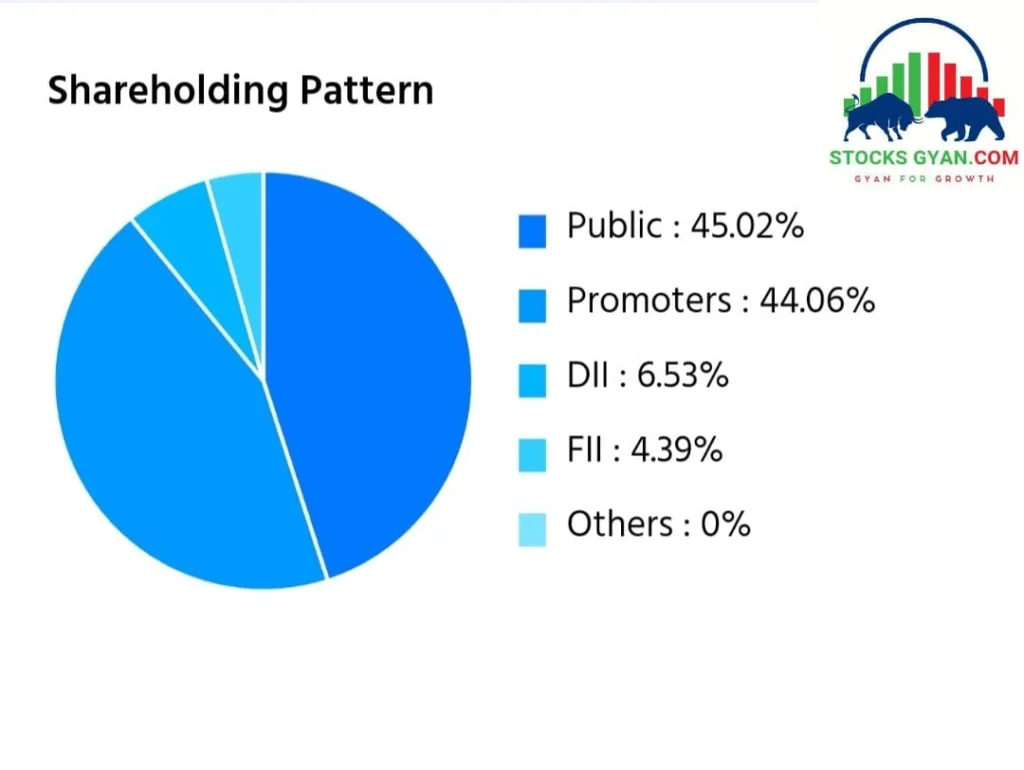

Rattan power Shareholding pattern

- Promoters : 44.06%

- FIIs : 4.39%

- DIIs : 6.53%

- Public : 45.02%

Rattan power Financial

Profit & loss All figures in Cr.

Particular | MAR 2021 | MAR 2022 | MAR 2023 | MAR 2024 |

Net Sales | 1,559.86 | 3,259.52 | 3,231.16 | 3,364 |

Total Expenditure | 1,188.15 | 2,451.97 | 2,472.29 | 2,732 |

Operating profit | 371.71 | 807.55 | 758.87 | 631.69 |

Other income | 616.51 | 353.22 | 349.97 | 370.11 |

Interest | 664.01 | 585.92 | 533.75 | 567.58 |

Depreciation | 227.51 | 226.71 | 222.07 | 237.34 |

Expectional Items | 0 | 0 | 0 | -1,245.14 |

Profit before Tax | 96.70 | 348.14 | 353.02 | -1,048.27 |

Provision for tax | 0 | 0 | 20.37 | - 20.37 |

Net profit | 96.70 | 348.14 | 332.65 | -1,027.91 |

Adjusted EPS | 0.18 | 0.65 | 0.62 | -1.91 |

So, I think 🤔 💬 you understand the financials of the company. Do you think that company can give good returns in the coming years?

Now let’s discuss the recent Rattan power result of Sep QTR net sales of Rs 682.43 Cr. in Sep 2024, down 14.31% from Rs 796.39 Cr. in Sep 2023, and quarterly net loss at Rs 1.35 Cr in September 2024.

Rattan power result for DEC 2024 net sales of Rs 733.32 Cr down 9.06% YoY, profit is also declined.

In Short Rattan power result is not good at all.

Rtnpower share price target 2025, 2030, 2040, 2050

| Rtnpower share price target 2025 | Share price target |

|---|---|

| 2025 | 12.20 |

| 2026 | 15.80 |

| 2027 | 28.90 |

| 2028 | 35.60 |

| 2029 | 39.60 |

| 2030 | 43.40 |

| 2040 | 67.70 |

| 2050 | 98.70 |

So Now read detailed analysis of Rtnpower share price target 2025, 2030, 2040, 2050.

Rattan power Share price target 2025

| Share price target 2025 | Rs. |

| First Target 🎯 | 12.00 |

| Second Target 🎯 | 16.80 |

| Third Target 🎯 | 28.50 |

As you know, power demand is increasing rapidly, so we can expect this target. As demand increases, company revenue and profit will automatically increase.

In 2025, the target price will be driven by demand. But wait, there are many to invest in why you choose Rtnpower share. Ask this question to yourself, then buy or reject 🤔.

Rattanindia power future Share price 2030

| Share price target 2030 | Rs. |

| First Target 🎯 | 35.80 |

| Second Target 🎯 | 39.20 |

| Third Target 🎯 | 43.40 |

In 2030, Rtnpower will try its best to achieve these targets, but how? With the help of company expansion, in the long term, the company has to focus on power plant expansion and shift to green energy. That push can help to achieve this share price target 🎯

Rattanindia power future Share price 2040

| Share price target 2040 | Rs. |

| First Target 🎯 | 55.20 |

| Second Target 🎯 | 60.80 |

| Third Target 🎯 | 67.70 |

Who knows the future? We only predict the price. If companies successfully give tough competition to competitors in terms of profit with expansion, this can create multibagger stock, but this is impossible, I guess!

Rattan Power plans to increase renewable energy projects, which can push target 🎯 price to great heights.

Rattanindia power future Share price 2050

| Share price Target 2050 | Rs. |

| First Target 🎯 | 84.00 |

| Second Target 🎯 | 90.20 |

| Third Target 🎯 | 98.70 |

I think we discuss many things about Target prices. 2050 is very long-term. This goes with good fundamentals, which you track on every financial ending year when the company posts a result.

Our website will update you on every quarterly result.

Company Strength 👍 and Weakness 👎

Strength

- The company has shown good Revenue growth of 29.20% for past 3 years.

- The company has Been maintaining operating margin of 24.86% in last 5 years.

- Company has healthy liquidity position with Current Ratio of 2.28.

Weakness

- Promoter pledging is High as 88.65%

- Company has high debtors days of 248.

- Company has low interest coverage ratio of -0.85.

- Company has poor ROE of -2.41% over past 3 years.

- Company has poor profit growth of -319.87% past 3 years.

So , this is all about Rattanindia power share price target 2025 Strength and weakness

Company Advantage and Disadvantage

Advantage

- Company future plans are to achieve 4 GW production.

- Company revenue growth was improving.

- Company repaid many outstanding loans from Sine 2020

Disadvantage

- Company profit growth was in negative

- pledging of share is very high

- Company debt was very high.

Conclusion

In short, to summarize the article for Rtnpower share price target 2025 to 2050, all this above price target is according to technical data, but in the long term, company work in fundamental data.

Currently, company is in a good mood to do business if company tries to focus on profit growth. 📈 Here real growth comes when profit increases.

FAQs

What is the target 🎯 price of Rtnpower share in 2025?

Rtnpower share price target 2025 price can touch Rs 18.50 per share in 2025.

What we can expect from Rattan power share in future?

As you know company is Penny stock, but company plans to target 4 GW production in coming years.

Disclaimer

All the information given on the website Stocksgyan.com, all news or ideas taken from a big website and presented here to add value, information, and accessibility,

We are not SEBI-registered advisors We don’t provide fake news or fake information on our website.Please🙏 don’t buy any stocks after reading this blog. Do your own analysis. Because money is yours, profit is yours, and loss is yours..👍Happy investing😄

“Hello! I’m Harsh sahu, a seasoned blogger with over 2 years of experience in crafting engaging, SEO-optimized content. My expertise lies in creating high-quality, keyword-driven blog posts that drive traffic, boost rankings, and captivate audiences.”