TPL plastech share price target 2025, 2030, 2040, 2050

Hello friends! 👋 A warm welcome to my website, Stocksgyan.com, to become a great investor. So, friends, In today’s article you are going to learn about TPL Plastech share price target 2025 and a full company analysis.

So read the full article to know more about the TPL Plastech company these company is growing rapidly in the plastic sector.

IS TPL plastech Multibagger in making, TPL plastech is the leading player in his space but what future hold for this company in 2025 to 2050 let’s discuss.

Company Introduction

TPL plastech was Founded in 1992 Company is the leading manufacturer and distributor of IBCs and packaging solutions.

TPL Plastech share price target 2025 As you plastic container space is continuously evolving this company is well positioned himself to compete with big Competitor as we discuss in Peer Comparison section in blog .

Company official website link 🖇️

Company Financial are improving on YOY So, What an investor can expect from this stock? TPL plastech limited share price currently trading at Rs 96.80 and hold a market capitalization of Rs 752.44 Cr.

TPL plastech is Manufacturing drums for Bulk packaging, this company also in polymer products.

TPL plastech Product and Services

The company is engaging in the manufacturing of drums for bulk packaging and also polymer products.

Let’s discuss more about the product in detail because business runs on good products.

1. Narrow Mouth drums

Narrow drums are manufactured by fully automatic blow-molding machines and designed with high drop resistance and having dimensions that help in FCL containers for exports.

Some features about this product.

- 100% liquid packing capacity range.

- High Resale value.

- pharma grade / lubes oil packing Ideal of Liquid Chemical

- Corrosion/ Rust free.

2. Narrow Mouth and wide mouth Carboys

This product has high acceptance in the market in both liquid and semi-liquid powder and some paste products. This is also used in chemical specialties.

Some features

- High drop impact Resistance.

- Easier to Handle this product.

3. Open Top Drums – Bulk & Medium

This types of Drum use in Packing powder and paste types products ( All drums have same features as above)

4. QuBC and COBO IBC Container

This is all about TPL plastech Product Analysis all this information collected from Company website.

Now move to TPL plastic Share overview after that we move towards your favourite topic 😄🎯 TPL plastech share price target 2025

Market Overview of TPL plastic Share

price summary

- Today’s high – ₹ 96.50

- Today’s Low – ₹ 93.51

- 52 week high – ₹ 136.00

- 52 week low – ₹ 51.35

| TERMS | VALUE |

|---|---|

| Market Capitalization | ₹ 753.44 Cr. |

| Entreprise Value | ₹ 772.14 Cr. |

| No. of Share | 7.80 Cr. |

| P/E | 34.55 |

| P/B | 5.62 |

| Face Value | ₹ 2 |

| Div yeild | 0.87% |

| Book Value | ₹ 17.17 |

| Cash | ₹ 5.46 Cr. |

| Debt | ₹ 25.16 Cr. |

| Promoter holding | 74.86% |

| EPS | ₹ 2.79 |

| Sales Growth | 15.64% |

| ROE | 16.15% |

| ROCE | 20.73% |

| Profit Growth | 23.79% |

Top Peer Comparison of TPL plastech with their market capitalization

Read Also Rossell India share price target 2025

1. Wim Plast

- Wimplast holds a market capitalization of ₹ 617.34 Cr. and share price trading at ₹ 514.10.

- Wim Plast Company specializes in manufacturing and selling various plastic products all over the world. The company offers air coolers, stools, dustbins, and central tables and many more items.

2. Kisan Moulding

- Kisan Moulding holds a Market Capitalization of ₹ 582.12 Cr. and share price trading at ₹ 48.54.

- kisan moulding specialized in manufacturing PVC pipes, and many more items.

3. Kriti Industries

- Kriti Industries holds a market capitalization of ₹ 737.83 Cr. and share price trading at ₹ 148.40.

- kriti Industries Specialized in manufacturing of drainage pipes .

So, In this part we discussed Competitor of TPL plastech share price target 2025.

Share price Chart 📈 of TPL plastech Ltd.

what chart is trying to tell us about the price? Let’s discuss

The first chart is the live TradingView chart on a daily time frame. So, currently TPL Plastech Limited’s share price is trading at ₹ 97 per share. In the bottom of the chart, you see some graph; this is called volume.

The second chart is the weekly chart. So, why weekly charts? Because for long-term targets, long time-frame charts are required. As you see the charts From Jan 2023, TPL Plastech Limited share price continuously increased and touched the high of ₹135 per share.

After that, TPL Plastic share continuously consolidated and touched a low of ₹94 per share. In 2022, the share price also split in a 1:5 ratio. Means 1 share converted into 5 shares. for short-term target 🎯 Share can again touch a 52-week high in the coming days.

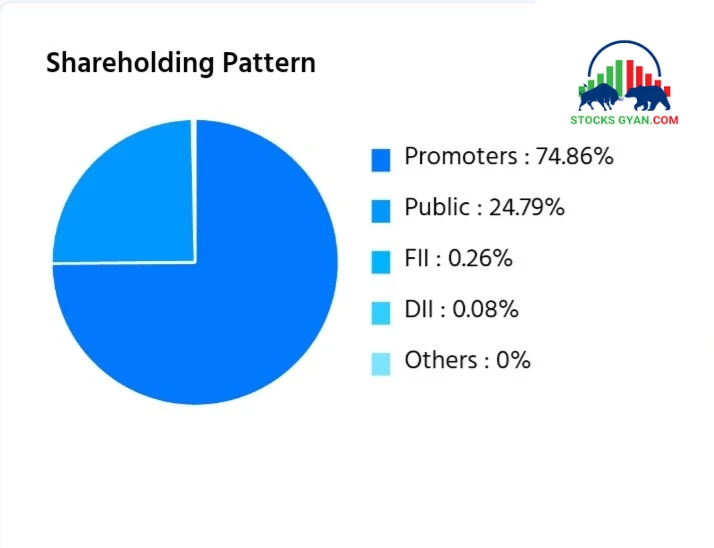

TPL plastech Share holding pattern

- Promoters – 74.86%

- Public – 24.79%

- FIIs – 0.26%

- DIIs 0.08%

Promoters are holding majority % without pledging any Share.

TPL plastech share technical {Buy or Sell}

The current technical indicators suggest a buy signal, but purchases should be limited due to a downward market trend and a monthly RSI of 40.

TPL plastech Financial

profit and loss all Figures are in Cr.

Particular | MAR 2021 | MAR 2022 | MAR 2023 | MAR 2024 |

Net Sales | 170 | 229 | 271 | 313 |

Total Expenditure | 150 | 202 | 241 | 277 |

Operating profit | 20 | 27 | 30 | 36 |

Other income | 0 | 0 | 1 | 0 |

Interest | 5 | 5 | 5 | 5 |

Depreciation | 4 | 4 | 5 | 6 |

Profit before Tax | 11 | 18 | 20 | 25 |

Tax % | 28% | 25% | 22% | 22% |

Net profit | 8 | 13 | 16 | 20 |

EPS in Rs | 1.03 | 1.71 | 2.06 | 2.54 |

Dividend payout % | 34% | 23% | 29% | 31% |

So, I think you see the Company Financial as you see Company Continue growing 📈 So, What do you think 🤔 TPL plastech Multibagger in making 😄. Let’s discuss Recent Final result.

The September 2024 quarter revenue at Rs. 889.50 millions, up 13.43% as compared to Rs. 784.19 millions during the corresponding quarter last year.Good Net Profit growth of 25.89% reported above the corresponding previous quarter figure of Rs. 42.56 millions to Rs. 53.58 millions. Operating profit of the company witnessed a growth to 97.49 millions from 87.40 millions in the same quarter last year.

Financial are good as of now , This is all about TPL plastech share price target 2025.

TPL plastech share price target 2025, 2030, 2040, 2050

| Targeting Years | Target Rs 🎯 |

|---|---|

| 2025 | 110.23 |

| 2026 | 120.20 |

| 2027 | 140.60 |

| 2028 | 110.90 |

| 2029 | 150.30 |

| 2030 | 165.30 |

| 2040 | 210.30 |

| 2050 | 360.50 |

So, Here are the Maximum and Minimum 🎯 price

TPL plastech Share price target 2025 💵

| Months | Target Rs 🎯 |

|---|---|

| January | 80.62 |

| February | 82.30 |

| March | 85.60 |

| April | 90.80 |

| May | 92.50 |

| June | 95.20 |

| July | 99.80 |

| August | 103.20 |

| September | 106.30 |

| October | 110.30 |

| November | 105.30 |

| December | 112 |

Tpl plastech Share Price Target 2026 💵

| Months | Target 🎯 Rs |

|---|---|

| January | 110.20 |

| February | 113.20 |

| March | 110.30 |

| April | 111 |

| May | 115.30 |

| June | 120.30 |

| July | 118.90 |

| August | 117.20 |

| September | 120.30 |

| October | 119.20 |

| November | 115.60 |

| December | 120.20 |

TPL plastech share price target 2027 💵

| Months | Target Rs 🎯 |

|---|---|

| January | 122.20 |

| February | 125.30 |

| March | 129.30 |

| April | 127.30 |

| May | 127.10 |

| June | 135.10 |

| July | 148.30 |

| August | 140.30 |

| September | 138.20 |

| October | 132.20 |

| November | 152.30 |

| December | 142.30 |

TPL Plastech Share price target 2028 💵

| Months | Target Rs 🎯 |

|---|---|

| January | 140.50 |

| February | 137.20 |

| March | 132.60 |

| April | 128.90 |

| May | 120.30 |

| June | 115.20 |

| July | 110.20 |

| August | 115.60 |

| September | 120.30 |

| October | 130.20 |

| November | 150.20 |

| December | 138.50 |

TPL plastech share price target 2029 💵

| Months | Targets 🎯 |

|---|---|

| January | 135.30 |

| February | 142.50 |

| March | 145.60 |

| April | 140.80 |

| May | 145.20 |

| June | 142.20 |

| July | 150.30 |

| August | 145.30 |

| September | 130.30 |

| October | 140.20 |

| November | 145.20 |

| December | 144.20 |

TPL plastech share price target 2030 💵

| Months | Targets 🎯 |

|---|---|

| January | 147.20 |

| February | 152.30 |

| March | 160.30 |

| April | 155.60 |

| May | 160.20 |

| June | 165.30 |

| July | 168.90 |

| August | 160.30 |

| September | 150.90 |

| October | 165 |

| November | 175.30 |

| December | 180.30 |

TPL plastech Strength 👍 and Weakness 👎

Strength

Read Also Kamopaints Share price target 2025

- The Company has Shown Good revenue growth of 22.44% from past 3 years.

- The Company is significantly Decreased its debt by 12.55 Cr.

- The Company has efficient cash conversion cycle of 39.65 days.

- The Company has High promoter holding of 74.86%.

- The Company has good Cash flow Management.

Weakness

- Company Don’t have Serious limitations.

Company Annual report

Conclusion

At last, we hope you like our analysis on the company target price. Kindly note that all of these targets are forecasts based on Technofunda analysis (technical + fundamental).

Put your own decision in terms of investing money in any of these companies. All of these are for educational purposes. 😄 Hope you like the article. As above mentioned, targets are easily achievable; you have to track company financial performance.

FAQs

What is the history of TPL Plastech?

The company was incorporated in 1992 at Bombay it was promoted by Tainwala chemical and plastic Limited.

What is the Credit rating of TPL plastech limited?

On June 2024 CRISIL gives a Rating of (A+ ) (Stable).

Who is the Chairman of TPL plastech limited?

Mr. Mk wadhwa is the chairman and independent director of TPL plastech limited.

Disclaimer

All the information given on the website Stocksgyan.com, all news or ideas taken from a big website and presented here to add value, information, and accessibility, We are not SEBI-registered advisors.

We don’t provide fake news or fake information on our website.Please🙏 don’t buy any stocks after reading this blog. Do your own analysis. Because money is yours, profit is yours, and loss is yours..👍Happy investing😄

“Hello! I’m Harsh sahu, a seasoned blogger with over 2 years of experience in crafting engaging, SEO-optimized content. My expertise lies in creating high-quality, keyword-driven blog posts that drive traffic, boost rankings, and captivate audiences.”