Vikas Ecotech Share Price Target 2025 to 2030

Vikas Ecotech Share price target 2030, So, before we understand share price target (so-called future prediction), firstly you need to understand what company does, how company makes money, and future planning.

So all of my dear readers, let’s get started to become great investors. We start with company business, then we move towards your favorite Vikas Ecotech share price target 2030 😄🤑

Vikas Ecotech official website Link

Company Introduction

Vikas Ecotech Share Price Target 2030: Vikas Ecotech Limited, a small-cap company with a market capitalization of ₹594 crores, shares price trading at ₹3.43 It is a penny stock (stay caution in penny stock); now let’s talk about business. Vikas Ecotech Limited is a multi-speciality product company that produces nature-friendly rubber plastic compounds and additives. Additionally, the company manufactures high-end chemical products and trades in TMT bars, CR coils, ERW pipes, HR coils, and coal.

The company’s main focus is to produce eco-friendly products. It’s good to know the company is very confident about future growth. As I see previous years of company growth was not so good, but slowly growth was improving. If Vikas Ecotech results improve, company share price is bound to increase.

Vikas ecotech products

- Speciality Additives: Organotin Stabilizer, Dimethyl Dichloride, and many more.

- polymer compound

- Recycled material

- Traded product.

In 2023, the company started trading coal and setup a plant in Gaziabad to produce MS sockets and pipe fittings. This is all about products. Lets move towards vikas ecotech share price target 2030 💵

Market view of Vikas ecotech limited

Price summary

- Today’s high – ₹ 2.97

- Today’s Low – ₹ 2.92

- 52 week high – ₹ 5.65

- 52 week low – ₹ 2.85

TERMS

VALUE

Market Cap

₹ 527.27 Cr.

Enterprise Value

₹ 543 Cr.

No.of shares

₹ 176.87 Cr.

P/E

33.37

P/B

0.96

Face Value

₹ 1

Div. Yield

0%

Book Value (TTM)

₹ 3.09

CASH

₹ 3.05 Cr.

DEBT

₹ 18.97 Cr.

Promoter Holding

10.65%

EPS(TTM)

₹ 0.09

Sales Growth

-38.75%

ROE

2.15%

ROCE

4.63%

Profit Growth

-30.58%

TERMS | VALUE |

Market Cap | ₹ 527.27 Cr. |

Enterprise Value | ₹ 543 Cr. |

No.of shares | ₹ 176.87 Cr. |

P/E | 33.37 |

P/B | 0.96 |

Face Value | ₹ 1 |

Div. Yield | 0% |

Book Value (TTM) | ₹ 3.09 |

CASH | ₹ 3.05 Cr. |

DEBT | ₹ 18.97 Cr. |

Promoter Holding | 10.65% |

EPS(TTM) | ₹ 0.09 |

Sales Growth | -38.75% |

ROE | 2.15% |

ROCE | 4.63% |

Profit Growth | -30.58% |

Brands

These are the brands of Vikas Ecotech Ltd.

- VEEPRENE

- VIKOLENE

- VIKOFLEX

- V-PET

- TINMATE

- THERMATE

- ADDFLEX

- V-ECOFLAMEX

Top peer comparison of Vikas Ecotech Limited with market capitalization

Here are three competitors of Vikas Ecotech ltd. with their approx Market Capitalization.

1. 3M India ltd.

- Market capitalization ₹ 32,466 Cr

- 3M India ltd is specialized in adhesive tape and related products.

2.Swan Energy Ltd.

- Market capitalization: ₹ 1302,25 Cr.

- Energy specializes in polymer, rubber, and paper products.

3. DCM Shriram Ltd.

- Market capitalization ₹ 510.95 Cr.

- This company specialized in Caustic soda, chlorine, aluminum chloride, calcium carbide, PVC resins, PVC compounds, power, and cement.

So I think you understand Vikas Ecotech Limited’s business. Let’s move towards Vikas ec.otech share price target 2030 💵

Share price chart of Vikas Ecotech Ltd.

This is the overall monthly chart. So now the question is how to read the chart and what the chart is trying to tell?

This is the monthly chart for the 2011 to 2024 long chart, which shows a price of Rs 6 per share in 2011 that touched Rs 25 per share in 2017. In 2018, the price touched an all-time high of Rs 48.50 per share after that selling started.

Price touch high of Rs 48.50 in 2018 to low Rs 1.50 per share in 2020 😄.From 2020 to 2024, consolidation continues. 2024 chart looks interesting because of volume sprouts. Buying has been seen in charts, but the price didn’t react till today.

So where to buy if share price crosses Rs 5.80 with volume, then only you buy, but in limited quantity. Vikas Ecotech share price target 2030 is a penny stock, and this type of stock is always risky for your pocket 💵😄👍

Promoter pledging %

Date | promoter % | pledge % |

Dec 2024 | 10.65 | 0.04 |

Sep 2024 | 10.66 | 0.04 |

June 2024 | 10.66 | 2.16 |

Mar 2024 | 13.58 | 2.16 |

Dec 2023 | 6.87 | 0.00 |

Sep 2023 | 6.87 | 0.00 |

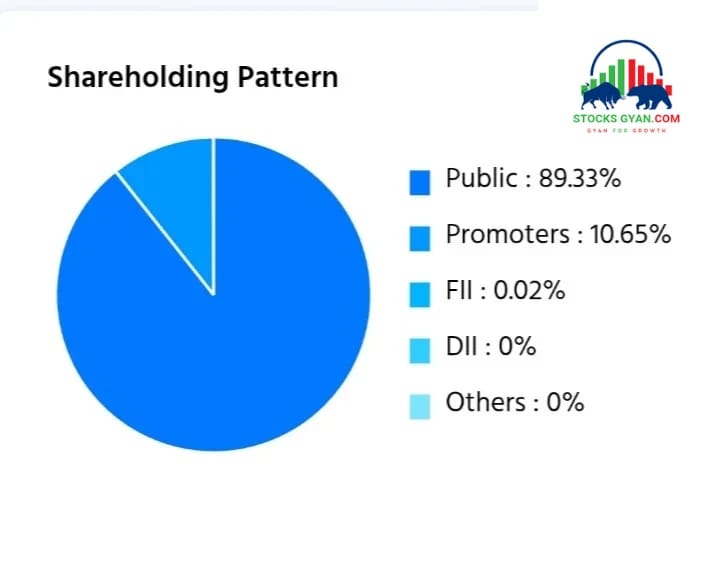

Vikas Ecotech Shareholding pattern :

- Promoters: 10.65%

- FIIs: 0%

- DIIs: 0%

- public: 89.33%

Majority stake is owned by public this is not good for company and FIIs is not holding this company

Vikas Ecotech financials

profit & Loss All figures in Cr.

Particular | MAR 2021 | MAR 2022 | MAR 2023 | MAR 2024 |

Net Sales | 116.18 | 250.42 | 402.67 | 246.60 |

Total Expenditure | 111.99 | 227.66 | 380.74 | 229.87 |

Operating Profit | 4.19 | 22.77 | 21.93 | 16.73 |

Other income | 4.87 | 2.02 | 3.18 | 3.11 |

Interest | 18.16 | 19.09 | 10.65 | 6.98 |

Depreciation | 3.96 | 3.60 | 3.96 | 3.75 |

Expectional Items | 0 | 0 | 0 | 0 |

Profit before Tax | -13.07 | 2.09 | 10.49 | 9.10 |

Tax | 1.28 | 0.70 | 0.96 | 2.49 |

Net profit | -14.35 | 1.39 | 9.53 | 6.61 |

Adjusted EPS | -0.32 | 0.01 | 0.10 | 0.05 |

After reading the recent financial statement, you are bound to think Vikas ecotech multibagger 😄 in making, So Wait!

So you see the financials of the company. Now I tell you the recent financial result for the June quarter ending. The sales were up around 38.58%, net profit zoomed to 549% from 15 million to 100 million, and operating profit saw very good growth to 154 million. Recent Vikas Ecotech results tell us that the company was improving that good for stock price.

Now let’s move towards Vikas ecotech share price target 2025 to 2030.

Vikas ecotech Share price target 2030, 2040, 2050

Vikas Ecotech share price target 2030 | Share price target |

2025 | ₹3 |

2026 | ₹4.50 |

2027 | ₹7.30 |

2028 | ₹ 8.10 |

2029 | ₹9.50 |

2030 | ₹12.30 |

2040 | ₹50.80 |

2050 | ₹92.20 |

So, Read detailed analysis of this Vikas ecotech Share price target 2030, 2040, 2050.

Read Also – Ceigall India Ltd Share price target

Vikas Ecotech share price target 2025:

| Vikas Ecotech share price target | Rs. |

| First Target 🎯 | 3.50 |

| Second Target 🎯 | 4.90 |

| Third Target 🎯 | 5.30 |

Vikas Ecotech share price will soar in 2025, according to data available in charts inside bar screener data. chart is showing selling volume has dried up in monthly charts.

So in the coming months of 2025, shares will boom, but buying volume has not been confirmed yet, so stay cautious. Rs 2.30 is the important support level to watch.If all news is good and market conditions are good, then we can expect the share price to go up to Rs. 8 or up to Rs. 12 per share.

Here are some key factors that help Vikas Ecotech share price target 2025 to reach Rs 8 to Rs 12 per share.

1. Eco-friendly products: Company shifts major focus to nature-friendly products; company to produce non-toxic and sustainable products So demand will automatically increase.

2. Company debt: In 2023, the company will stand with a Rs 42 crore debt. In 2024, the company will have Rs 18 crore of debt. So this is good stuff. The company was to become debt-free in the year ending 2024, but the target not achieved next year. The company will achieve it.

3. Global expansion: The Company puts in good effort to step into foreign countries to expand business and achieve great heights in terms of revenue and profit. So this factor can help Vikas Ecotech share price target 2025 to achieve Rs. 8 to 12.

Stay cautious because it is a penny stock. To achieve a good target, the company has to do good business in a very competitive market.Buy at your own risk.

Vikas Ecotech share price target 2030

| Vikas Ecotech share price target | Rs. |

| First Target 🎯 | 9.80 |

| Second Target 🎯 | 12.10 |

| Third Target 🎯 | 12.50 |

Vikas Ecotech share price target 2030 can achieve Rs 13 per share So, you want to know how the company reaches that level. Stay on the blog.

Company strategic move towards R&D to find great tech with innovative products and services; company already fulfilled many big deals with the help of innovative products with high margins;

Company main focus was on eco-friendly products and boost market presence, aiming to touch Rs 13 target 🎯. In recent times, companies acquired steel companies and coal trading companies.

Vikas Ecotech share price target 2040

| Vikas Ecotech target 2040 | Rs. |

| First Target 🎯 | 50.80 |

| Second Target 🎯 | 55.80 |

| Third target 🎯 | 62.30 |

This target of 2040 is for the long term. No doubt if company growth is 15% to 20% annually, this target of Rs 60 per share target is nothing, but in this business, high competition with their great competitor to tackle with this company needs to expand his business exponentially at top speed 🚅

These only happen when company focus is not shifting to anywhere because, in this case, the company has a big competitor, which can create panic on profit margin. The company’s recent financial result was good. Since many years, the company chart has been consolidating in the tight range of Rs 2 to Rs 5.Vikas Ecotech share price target 2040 will achieve 50 to 60 Rs. (Risky Stock).

Vikas Ecotech share price target 2050

| Vikas Ecotech target 2050 | Rs. |

| First Target 🎯 | 92.20 |

| Second Target 🎯 | 93.10 |

| Third Target | 98 |

At last, Vikas Ecotech share price target 2050 💵 To achieve the target of Rs 100 companies, you need to work very hard with dedication because of the big players already in the market.

If a company wants to be at the top, its only focus is on a good product with a good distribution channel. High production capacity was required to tackle orders. This is very hard to tell whether the company perform well or not in the future.

The share buying decision is yours only with calculated risk.

Company Strength👍 and weakness👎

Strength

- The company has shown good profit growth of 35.01% for past 3 years.

- Thee company has shown good revenue growth of 28.50% for past 3 years.

- Company has virtually debt free.

- The company has good cash flow management; PAT stands at 55.08.

- Company has Significantly decreased the debt.

Weakness

- Company trading at high PE of 33.37

- Company has poor ROE of 2.35% over the past 3 years.

- Promoter pleding has increased from 0.04% to 0.01% in 1 quarter.

Company Advantage and Disadvantage

Advantage

- The company can become a leading player in the chemical sector because its profit margin is improving.

- company can become a leading player in the market because the product segment was good.

- Company produces special products Recycled product & special polymers with toxic-free item.

- India govt. supports chemical sector. In budget govt. make scheme for chemical sector.

- Company financials were improving, and profit margins were also.

Disadvantage

- Company promoter holding decreased by 4.90% over the last 3 years.

- In the chemical sector, there are many old and experienced companies to compete with Vikas Ecotech.

Vikas Ecotech Financial Report

- Financial Report 2024 Report

- Financial Report 2023 Report

- Financial Report 2022 Report

- Financial Report 2021 Report

Conclusion

Vikas Ecotech share price target 2030, 2040, 2050, The company has good financials as of now because of the green product Vikas ecotech multibagger in making.

The company also increased focus on management for planning, execution, and many other things. By doing a lot of hard work in sales, revenue, and production, all share price targets were achievable.

We give maximum details about the company. So you decide whether to buy or not. This is all about vikas Ecotech share price target 2030.

FAQs

Is vikas Ecotech is debt free?

Vikas Ecotech share is virtually debt free, company targeted that it will become debt free by 2024; company debt around 18 cr from 42 cr

Vikas Ecotech share is good for short term buying?

No, This share is not good for short term only for long term with with less capital.

Is vikas Ecotech is become multibagger in future?

Yes, company can become multibagger in future if company do good business with great financial.

Disclaimer

All the information given on the website Stocksgyan.com, all news or ideas taken from a big website and presented here to add value, information, and accessibility, We are not SEBI-registered advisors.

We don’t provide fake news or fake information on our website. Please don’t 🙏 buy any stocks after reading this blog. Do your own analysis. Because money is yours, profit is yours, and loss is yours..👍Happy investing😄

“Hello! I’m Harsh sahu, a seasoned blogger with over 2 years of experience in crafting engaging, SEO-optimized content. My expertise lies in creating high-quality, keyword-driven blog posts that drive traffic, boost rankings, and captivate audiences.”